Self Employment Earnings Form - State Of Hawaii Department Of Human Services

ADVERTISEMENT

State of Hawaii

Benefit Employment & Support Services Division

Department of Human Services

Low Income Home Energy Assistance Program (LIHEAP)

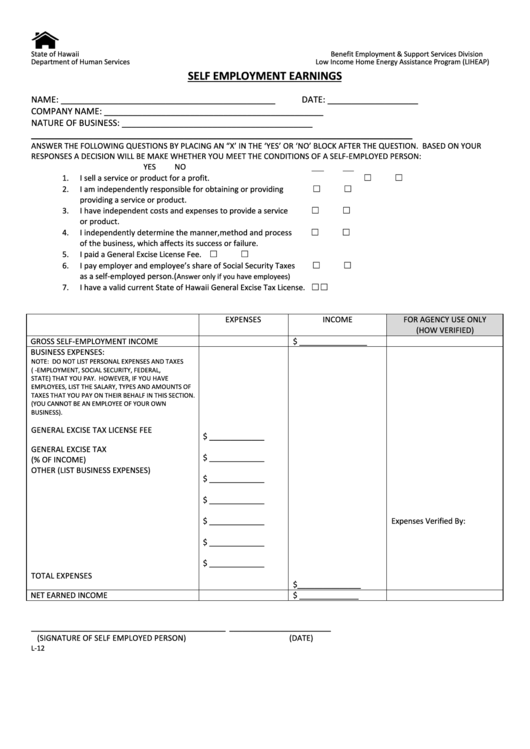

SELF EMPLOYMENT EARNINGS

NAME: _____________________________________________

DATE: ___________________

COMPANY NAME: ______________________________________________

NATURE OF BUSINESS: ________________________________________

________________________________________________________________________________

ANSWER THE FOLLOWING QUESTIONS BY PLACING AN “X’ IN THE ‘YES’ OR ‘NO’ BLOCK AFTER THE QUESTION. BASED ON YOUR

RESPONSES A DECISION WILL BE MAKE WHETHER YOU MEET THE CONDITIONS OF A SELF-EMPLOYED PERSON:

YES

NO

1.

I sell a service or product for a profit.

☐

☐

2.

I am independently responsible for obtaining or providing

☐

☐

providing a service or product.

3.

I have independent costs and expenses to provide a service

☐

☐

or product.

4.

I independently determine the manner, method and process

☐

☐

of the business, which affects its success or failure.

5.

I paid a General Excise License Fee.

☐

☐

6.

I pay employer and employee’s share of Social Security Taxes

☐

☐

as a self-employed person.(

Answer only if you have employees)

7.

I have a valid current State of Hawaii General Excise Tax License. ☐

☐

EXPENSES

INCOME

FOR AGENCY USE ONLY

(HOW VERIFIED)

GROSS SELF-EMPLOYMENT INCOME

$ ________________

BUSINESS EXPENSES:

NOTE: DO NOT LIST PERSONAL EXPENSES AND TAXES

(I.E. SELF-EMPLOYMENT, SOCIAL SECURITY, FEDERAL,

STATE) THAT YOU PAY. HOWEVER, IF YOU HAVE

EMPLOYEES, LIST THE SALARY, TYPES AND AMOUNTS OF

TAXES THAT YOU PAY ON THEIR BEHALF IN THIS SECTION.

(YOU CANNOT BE AN EMPLOYEE OF YOUR OWN

BUSINESS).

GENERAL EXCISE TAX LICENSE FEE

$ _____________

GENERAL EXCISE TAX

$ _____________

(% OF INCOME)

OTHER (LIST BUSINESS EXPENSES)

$ _____________

$ _____________

$ _____________

Expenses Verified By:

$ _____________

$ _____________

TOTAL EXPENSES

$_______________

NET EARNED INCOME

$ ______________

______________________________________________

________________________

(SIGNATURE OF SELF EMPLOYED PERSON)

(DATE)

L-12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1