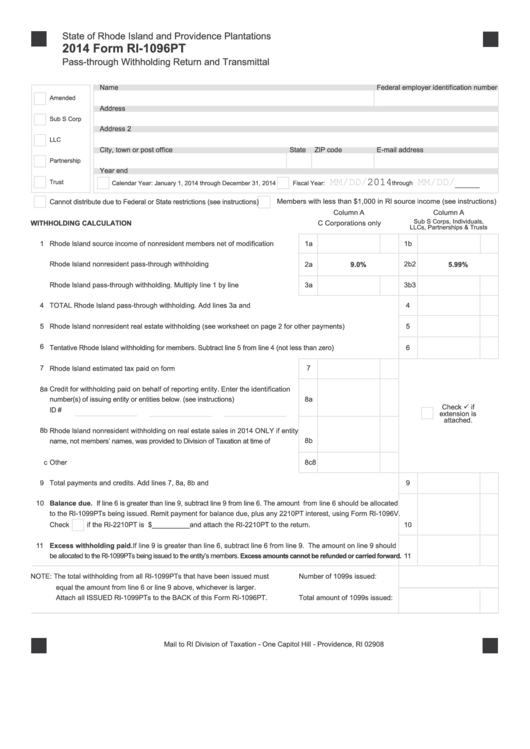

State of Rhode Island and Providence Plantations

2014 Form RI-1096PT

Pass-through Withholding Return and Transmittal

Name

Federal employer identification number

Amended

Address

Sub S Corp

Address 2

LLC

City, town or post office

State

ZIP code

E-mail address

Partnership

Year end

MM/DD/2014

MM/DD/____

Trust

through

Calendar Year: January 1, 2014 through December 31, 2014

Fiscal Year:

Cannot distribute due to Federal or State restrictions (see instructions)

Members with less than $1,000 in RI source income (see instructions)

Column A

Column A

Sub S Corps, Individuals,

WITHHOLDING CALCULATION

C Corporations only

LLCs, Partnerships & Trusts

1

Rhode Island source income of nonresident members net of modification .............

1a

1b

2

Rhode Island nonresident pass-through withholding rate........................................

2a

9.0%

2b

5.99%

3

Rhode Island pass-through withholding. Multiply line 1 by line 2.............................

3a

3b

4

TOTAL Rhode Island pass-through withholding. Add lines 3a and 3b .........................................................................

4

5

Rhode Island nonresident real estate withholding (see worksheet on page 2 for other payments)............................

5

6

Tentative Rhode Island withholding for members. Subtract line 5 from line 4 (not less than zero)....................................

6

7

7

Rhode Island estimated tax paid on form RI-1096PT-ES ........................................

8

a

number(s) of issuing entity or entities below. (see instructions) ....................................

8a

Check ü if

ID #

extension is

attached.

8 Rhode Island nonresident withholding on real estate sales in 2014 ONLY if entity

b

8b

name, not members’ names, was provided to Division of Taxation at time of closing .....

8

c

Other payments....................................................................................................... 8c

9

Total payments and credits. Add lines 7, 8a, 8b and 8c...............................................................................................

9

10 Balance due. If line 6 is greater than line 9, subtract line 9 from line 6. The amount from line 6 should be allocated

to the RI-1099PTs being issued. Remit payment for balance due, plus any 2210PT interest, using Form RI-1096V.

Check

if the RI-2210PT is attached.Enter interest due $__________and attach the RI-2210PT to the return.

10

11 Excess withholding paid. If line 9 is greater than line 6, subtract line 6 from line 9. The amount on line 9 should

be allocated to the RI-1099PTs being issued to the entity’s members. Excess amounts cannot be refunded or carried forward. 11

NOTE: The total withholding from all RI-1099PTs that have been issued must

Number of 1099s issued:

Attach all ISSUED RI-1099PTs to the BACK of this Form RI-1096PT.

Total amount of 1099s issued:

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908

1

1 2

2