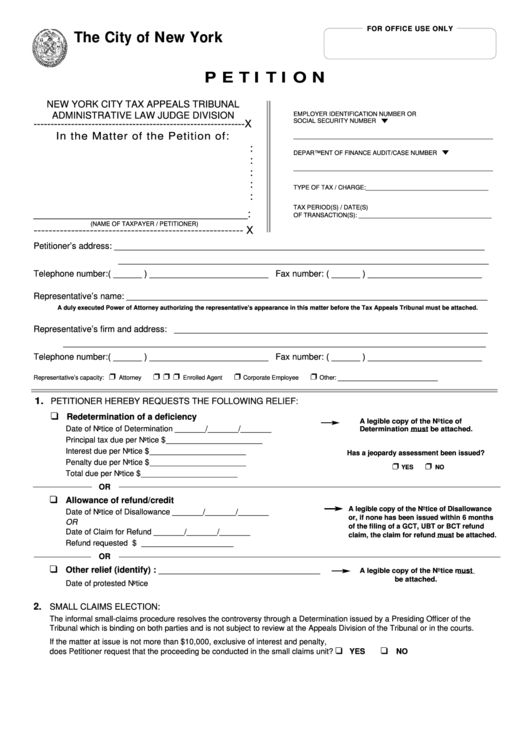

FOR OFFICE USE ONLY

The City of New York

P E T I T I O N

NEW YORK CITY TAX APPEALS TRIBUNAL

EMPLOYER IDENTIFICATION NUMBER OR

ADMINISTRATIVE LAW JUDGE DIVISION

SOCIAL SECURITY NUMBER

--------------------------------------------------------------X

In the Matter of the Petition of

:

_____________________________________________

:

DEPARTMENT OF FINANCE AUDIT/CASE NUMBER

:

_____________________________________________

:

:

TYPE OF TAX / CHARGE: ____________________________________

:

TAX PERIOD(S) / DATE(S)

__________________________________:

OF TRANSACTION(S): _______________________________________

(NAME OF TAXPAYER / PETITIONER)

--------------------------------------------------------X

Petitioner’s address: ______________________________________________________________________________

______________________________________________________________________________

Telephone number:

( ______ ) _________________________ Fax number: ( ______ ) ________________________

Representative’s name: ____________________________________________________________________________

A duly executed Power of Attorney authorizing the representative's appearance in this matter before the Tax Appeals Tribunal must be attached.

Representative’s firm and address: __________________________________________________________________

_________________________________________________________________________________________

Telephone number:

( ______ ) _________________________ Fax number: ( ______ ) ________________________

_____________________

Representative’s capacity:

Attorney

C.P.A.

P.A.

Enrolled Agent

Corporate Employee

Other:

1.

PETITIONER HEREBY REQUESTS THE FOLLOWING RELIEF:

Redetermination of a deficiency

A legible copy of the Notice of

Date of Notice of Determination

_______/_______/_______

Determination must be attached.

...............................

Principal tax due per Notice

$______________________

........................................

Interest due per Notice

$______________________

...................................................

Has a jeopardy assessment been issued?

Penalty due per Notice

$______________________

...................................................

YES

NO

Total due per Notice

$______________________

.........................................................

OR

Allowance of refund/credit

A legible copy of the Notice of Disallowance

Date of Notice of Disallowance

_______/_______/_______

................................

or, if none has been issued within 6 months

OR

of the filing of a GCT, UBT or BCT refund

Date of Claim for Refund

_______/_______/_______

..............................................

claim, the claim for refund must be attached.

Refund requested

$ _____________________

.............................................................

OR

Other relief (identify) : __________________________________

A legible copy of the Notice must

be attached.

Date of protested Notice

............................ _______/_______/_______

2.

SMALL CLAIMS ELECTION:

The informal small-claims procedure resolves the controversy through a Determination issued by a Presiding Officer of the

Tribunal which is binding on both parties and is not subject to review at the Appeals Division of the Tribunal or in the courts.

If the matter at issue is not more than $10,000, exclusive of interest and penalty,

does Petitioner request that the proceeding be conducted in the small claims unit?

YES

NO

...............................................

1

1 2

2