Form 656-P - Offer In Compromise

ADVERTISEMENT

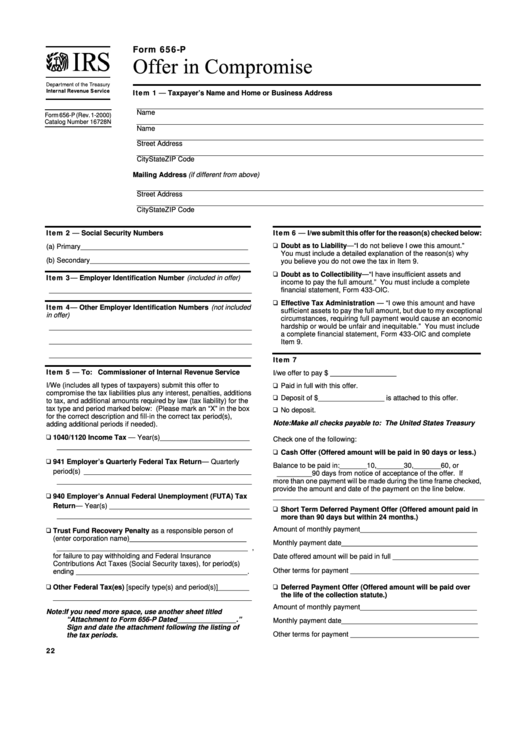

Form 656-P

Offer in Compromise

Item 1 — Taxpayer’s Name and Home or Business Address

_________________________________________________________________________________________

Name

Form 656-P (Rev. 1-2000)

_________________________________________________________________________________________

Catalog Number 16728N

Name

_________________________________________________________________________________________

Street Address

_________________________________________________________________________________________

City

State

ZIP Code

Mailing Address (if different from above)

_________________________________________________________________________________________

Street Address

_________________________________________________________________________________________

City

State

ZIP Code

Item 6 — I/we submit this offer for the reason(s) checked below:

Item 2 — Social Security Numbers

Doubt as to Liability — “I do not believe I owe this amount.”

(a) Primary ___________________________________________

You must include a detailed explanation of the reason(s) why

(b) Secondary _________________________________________

you believe you do not owe the tax in Item 9.

Doubt as to Collectibility — “I have insufficient assets and

Item 3 — Employer Identification Number (included in offer)

income to pay the full amount.” You must include a complete

____________________________________________________

financial statement, Form 433-OIC.

Effective Tax Administration — “I owe this amount and have

Item 4 — Other Employer Identification Numbers (not included

sufficient assets to pay the full amount, but due to my exceptional

in offer)

circumstances, requiring full payment would cause an economic

hardship or would be unfair and inequitable.” You must include

____________________________________________________

a complete financial statement, Form 433-OIC and complete

____________________________________________________

Item 9.

____________________________________________________

Item 7

Item 5 — To: Commissioner of Internal Revenue Service

I/we offer to pay $ _________________

I/We (includes all types of taxpayers) submit this offer to

Paid in full with this offer.

compromise the tax liabilities plus any interest, penalties, additions

Deposit of $ _________________ is attached to this offer.

to tax, and additional amounts required by law (tax liability) for the

tax type and period marked below: (Please mark an “X” in the box

No deposit.

for the correct description and fill-in the correct tax period(s),

Note: Make all checks payable to: The United States Treasury

adding additional periods if needed).

1040/1120 Income Tax — Year(s) _______________________

Check one of the following:

__________________________________________________

Cash Offer (Offered amount will be paid in 90 days or less.)

941 Employer’s Quarterly Federal Tax Return — Quarterly

Balance to be paid in: _______ 10, _______ 30, _______ 60, or

period(s) ___________________________________________

_________ 90 days from notice of acceptance of the offer. If

__________________________________________________

more than one payment will be made during the time frame checked,

provide the amount and date of the payment on the line below.

940 Employer’s Annual Federal Unemployment (FUTA) Tax

_____________________________________________________________________________

Return — Year(s) ____________________________________

Short Term Deferred Payment Offer (Offered amount paid in

__________________________________________________

more than 90 days but within 24 months.)

Amount of monthly payment ______________________________

Trust Fund Recovery Penalty as a responsible person of

(enter corporation name) ______________________________

Monthly payment date ___________________________________

_________________________________________________ ,

for failure to pay withholding and Federal Insurance

Date offered amount will be paid in full ______________________

Contributions Act Taxes (Social Security taxes), for period(s)

Other terms for payment _________________________________

ending ____________________________________________ .

Other Federal Tax(es) [specify type(s) and period(s)] ________

Deferred Payment Offer (Offered amount will be paid over

the life of the collection statute.)

___________________________________________________

Amount of monthly payment ______________________________

Note: If you need more space, use another sheet titled

“Attachment to Form 656-P Dated _______________ .”

Monthly payment date ___________________________________

Sign and date the attachment following the listing of

Other terms for payment _________________________________

the tax periods.

22

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2