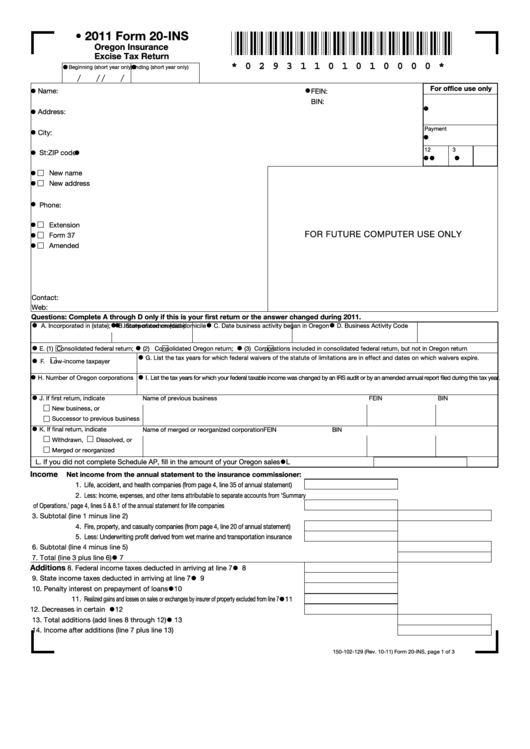

• 2011 Form 20-INS

Oregon Insurance

Excise Tax Return

•

•

* 0 2 9 3 1 1 0 1 0 1 0 0 0 0 *

Beginning (short year only)

Ending (short year only)

/

/

/

/

•

•

For office use only

Name:

FEIN:

BIN:

•

•

Address:

•

Payment

City:

•

•

•

1

2

3

St:

ZIP code:

•

•

•

•

New name

•

New address

•

Phone:

•

Extension

•

FOR FUTURE COMPUTER USE ONLY

Form 37

•

Amended

Contact:

Web:

Questions: Complete A through D only if this is your first return or the answer changed during 2011.

•

•

•

•

•

A. Incorporated in (state);

Incorporated on (date)

B. State of commercial domicile

C. Date business activity began in Oregon

D. Business Activity Code

•

•

•

E. (1)

Consolidated federal return;

(2)

Consolidated Oregon return;

(3)

Corporations included in consolidated federal return, but not in Oregon return

•

•

G. List the tax years for which federal waivers of the statute of limitations are in effect and dates on which waivers expire.

F.

Low-income taxpayer

•

•

H. Number of Oregon corporations

I. List the tax years for which your federal taxable income was changed by an IRS audit or by an amended annual report filed during this tax year.

•

J. If first return, indicate

Name of previous business

FEIN

BIN

New business, or

Successor to previous business

•

K. If final return, indicate

Name of merged or reorganized corporation

FEIN

BIN

Withdrawn,

Dissolved, or

Merged or reorganized

•

L. If you did not complete Schedule AP, fill in the amount of your Oregon sales ......................................

L

Income

Net income from the annual statement to the insurance commissioner:

1. Life, accident, and health companies (from page 4, line 35 of annual statement) ....1

2. Less: Income, expenses, and other items attributable to separate accounts from ‘Summary

of Operations,’ page 4, lines 5 & 8.1 of the annual statement for life companies ............2

3. Subtotal (line 1 minus line 2) .................................................................................................................. 3

4. Fire, property, and casualty companies (from page 4, line 20 of annual statement) .....4

5. Less: Underwriting profit derived from wet marine and transportation insurance ....5

6. Subtotal (line 4 minus line 5) .................................................................................................................. 6

•

7. Total (line 3 plus line 6) ......................................................................................................................

7

•

Additions

8. Federal income taxes deducted in arriving at line 7 .........................

8

•

9. State income taxes deducted in arriving at line 7 ............................

9

•

10. Penalty interest on prepayment of loans ..........................................

10

•

11. Realized gains and losses on sales or exchanges by insurer of property excluded from line 7 ....

11

•

12. Decreases in certain reserves...........................................................

12

•

13. Total additions (add lines 8 through 12) ..........................................................................................

13

14. Income after additions (line 7 plus line 13) .......................................................................................... 14

150-102-129 (Rev. 10-11) Form 20-INS, page 1 of 3

1

1 2

2 3

3