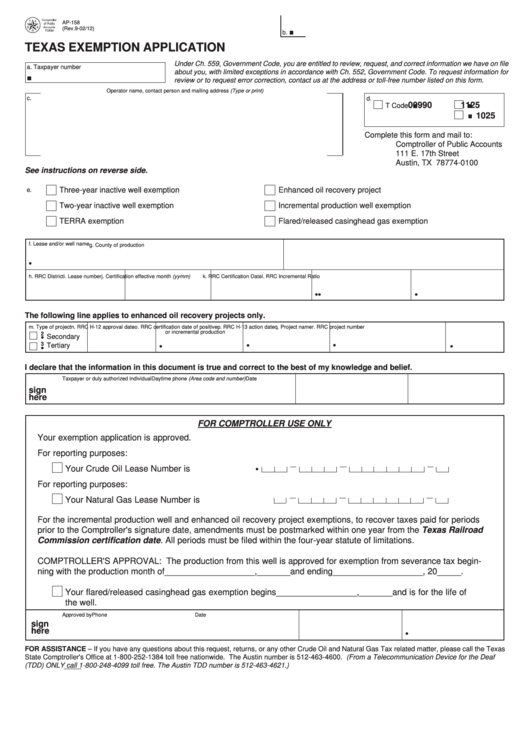

AP-158

(Rev.9-02/12)

b.

TEXAS EXEMPTION APPLICATION

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we have on file

a. Taxpayer number

about you, with limited exceptions in accordance with Ch. 552, Government Code. To request information for

review or to request error correction, contact us at the address or toll-free number listed on this form.

Operator name, contact person and mailing address (Type or print)

c.

d.

00990

1125

T Code

1025

Complete this form and mail to:

Comptroller of Public Accounts

111 E. 17th Street

Austin, TX 78774-0100

See instructions on reverse side.

e.

Three-year inactive well exemption

Enhanced oil recovery project

Two-year inactive well exemption

Incremental production well exemption

TERRA exemption

Flared/released casinghead gas exemption

f. Lease and/or well name

g. County of production

•

h. RRC District

i. Lease number

j. Certification effective month (yymm)

k. RRC Certification Date

l. RRC Incremental Ratio

•

•

•

The following line applies to enhanced oil recovery projects only.

m. Type of project

n. RRC H-12 approval date

o. RRC certification date of positive

p. RRC H-13 action date

q. Project name

r. RRC project number

or incremental production

2

Secondary

•

3

•

•

Tertiary

•

•

•

I declare that the information in this document is true and correct to the best of my knowledge and belief.

Taxpayer or duly authorized individual

Daytime phone (Area code and number)

Date

sign

here

FOR COMPTROLLER USE ONLY

Your exemption application is approved.

For reporting purposes:

Your Crude Oil Lease Number is

•

For reporting purposes:

Your Natural Gas Lease Number is

For the incremental production well and enhanced oil recovery project exemptions, to recover taxes paid for periods

prior to the Comptroller's signature date, amendments must be postmarked within one year from the Texas Railroad

Commission certification date. All periods must be filed within the four-year statute of limitations.

COMPTROLLER'S APPROVAL: The production from this well is approved for exemption from severance tax begin-

ning with the production month of ___________________ , _______ and ending ___________________ , 20 _____ .

Your flared/released casinghead gas exemption begins _________________ , _______ and is for the life of

the well.

Approved by

Phone

Date

sign

here

•

FOR ASSISTANCE – If you have any questions about this request, returns, or any other Crude Oil and Natural Gas Tax related matter, please call the Texas

State Comptroller's Office at 1-800-252-1384 toll free nationwide. The Austin number is 512-463-4600. (From a Telecommunication Device for the Deaf

(TDD) ONLY call 1-800-248-4099 toll free. The Austin TDD number is 512-463-4621.)

1

1 2

2