Form Ct-28 - Schedule F - Sales And Transfers Of Connecticut-Stamped Cigarettes Outside Of Connecticut - 2007

ADVERTISEMENT

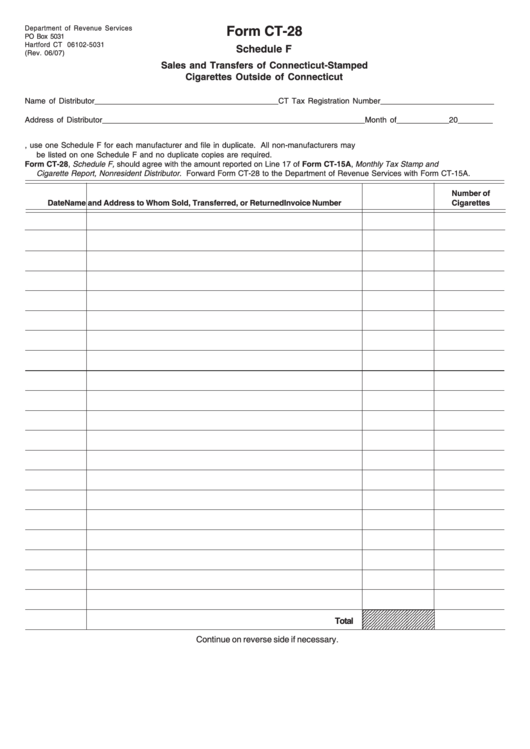

Form CT-28

Department of Revenue Services

PO Box 5031

Hartford CT 06102-5031

Schedule F

(Rev. 06/07)

Sales and Transfers of Connecticut-Stamped

Cigarettes Outside of Connecticut

Name of Distributor __________________________________________ CT Tax Registration Number __________________________

Address of Distributor ____________________________________________________________ Month of ____________ 20 ________

1. Nonresident distributors selling or transferring Connecticut-stamped cigarettes outside of Connecticut must file this schedule.

2. When manufacturers are listed below, use one Schedule F for each manufacturer and file in duplicate. All non-manufacturers may

be listed on one Schedule F and no duplicate copies are required.

3. The total of Form CT-28, Schedule F, should agree with the amount reported on Line 17 of Form CT-15A, Monthly Tax Stamp and

Cigarette Report, Nonresident Distributor. Forward Form CT-28 to the Department of Revenue Services with Form CT-15A.

Number of

Date

Name and Address to Whom Sold, Transferred, or Returned

Invoice Number

Cigarettes

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

Total

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

Continue on reverse side if necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2