Form Wcwt-5 Application For Refund Of Wilmington City Wage Tax 2006

ADVERTISEMENT

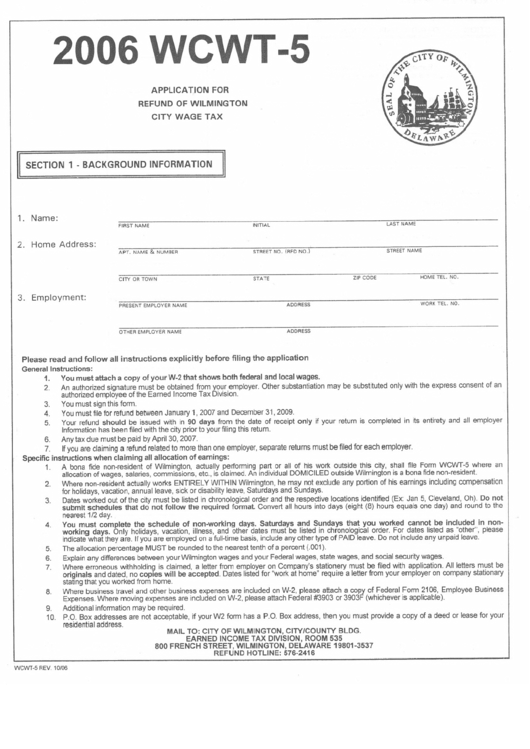

2006 WCWT-5

APPLICATION

FOR

REFUND OF WILMINGTON

CITY

WAGE TAX

I

SECTION 1

-

BACKGROUND INFORMATION

1. Name:

FIRST NAME

INITIAL

lAST

NAME

2. Home

Address:

APT. NAME & NUMBER

STREET NO. (RFD NO.)

STREET NAME

CITY OR TOWN

STATE

ZIP COOE

HOME TEL. NO.

3. Employment:

PRESENT EMPLOYER

NAME

ADDRESS

WORK TEL. NO.

OTHER EMPLOYER

NAME

ADORESS

Please read and follow

all instructions

explicitly

before filing the application

General Instructions:

1.

You must attach a copy of your W-2 that shows both federal and local wages.

2.

An authorized signature must be obtained from your employer. Other substantiation may be substituted only with the express consent of an

authorized employee of the Earned Income Tax Division.

You must sign this form.

You must file for refund between January 1,2007 and December 31,2009.

Your refund

should

be issued with in 90 days from the date of receipt

only

if your return is completed in its entirety and all employer

Information has been filed with the city prior to your filing this return.

6.

Any tax due must be paid by April

30, 2007.

7.

If you are claiming a refund related to more than one employer, separate returns must be filed for each employer.

Specific instructions

when claiming all allocation

of earnings:

1.

A bona fide non-resident of Wilmington, actually performing part or all of his work outside this city, shall file Form WCWf-5 where an

allocation of wages, salaries, commissions, etc., is claimed. An individual DOMICILED outside Wilmington is a bona fide non-resident.

2.

Where non-resident actually works ENTIRELY WITHIN Wilmington, he may not exclude any portion of his earnings including compensation

for holidays, vacation, annual leave, sick or disability leave, Saturdays and Sundays.

3.

Dates worked out of the city must be listed in chronological order and the respective locations identified (Ex: Jan 5, Cleveland,

Oh). Do not

submit schedules that do not follow the required fonnal

Convert all hours into days (eight (8) hours equals one day) and round to the

nearest

1/2 day. .

4.

You must complete the schedule of non-working days. Saturdays and Sundays that you worked cannot be included in non-

working days. Only

holidays,

vacation,

illness, and other dates must be listed in chronological

order. For dates listed as "other", please

indicate what they are. If you are employed

on a full-time basis, include any other type of PAID leave. Do not include any unpaid leave.

The allocation percentage

MUST be rounded to the nearest tenth of a percent (.001).

Explain any differences

between your Wilmington

wages and your Federal wages, state wages, and social security wages.

Where erroneous

withholding

is claimed,

a letter from employer on Company's

stationery

must be filed with application.

All letters must be

originals and dated, no copies will be accepted.

Dates listed for ''work at home" require a letter from your employer on company stationary

stating that you worked from home.

8.

Where business travel and other business

expenses

are included on W-2, please attach a copy of Federal Form 2106, Employee

Business

~xpenses.

Where moving expenses

are included on W-2, please attach Federal #3903 or 3903F (whichever

is applicable).

9.

Additional information

may be required.

10.

P.O. Box addresses

are not acceptable,

if your W2 form has a P.O. Box address, then you must provide a copy of a deed or lease for your

residential address.

3.

4.

5.

5.

6.

7.

MAil TO: CITY OF WilMINGTON,

CITY/COUNTY BLDG.

EARNED INCOME TAX DIVISION, ROOM 535

800 FRENCH STREET, WilMINGTON,

DELAWARE 19801-3537

REFUND HOTLINE: 576-2416

WCWT-5

REV. 10106

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4