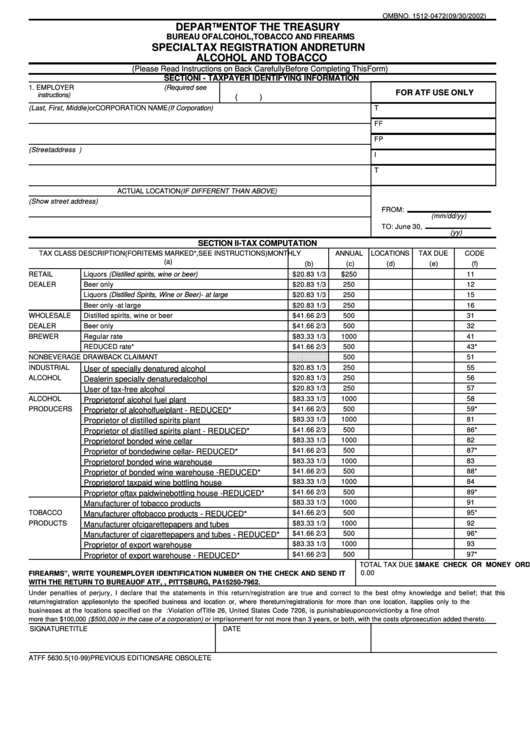

Form Atf F 5630.5 Special Tax Registration And Return Alcohol And Tobacco

ADVERTISEMENT

OMB NO. 1512-0472 (09/30/2002)

DEPARTMENT OF THE TREASURY

BUREAU OF ALCOHOL, TOBACCO AND FIREARMS

SPECIAL TAX REGISTRATION AND RETURN

ALCOHOL AND TOBACCO

(Please Read Instructions on Back Carefully Before Completing This Form)

SECTION I - TAXPAYER IDENTIFYING INFORMATION

1. EMPLOYER IDENTIFICATION NUMBER

(Required see

2. BUSINESS TELEPHONE NUMBER

FOR ATF USE ONLY

instructions)

(

)

3. NAME (Last, First, Middle)

or

CORPORATION NAME (If Corporation)

T

FF

4. TRADE NAME

FP

5. MAILING ADDRESS (Street address or P.O. box number)

I

6. CITY

STATE

ZIP CODE

T

ACTUAL LOCATION (IF DIFFERENT THAN ABOVE)

9. TAX PERIOD COVERING

7. PHYSICAL ADDRESS OF PRINCIPAL PLACE OF BUSINESS (Show street address)

FROM:

(mm/dd/yy)

8. CITY

STATE

ZIP CODE

TO: June 30,

(yy)

SECTION II - TAX COMPUTATION

TAX CLASS DESCRIPTION (FOR ITEMS MARKED*, SEE INSTRUCTIONS)

MONTHLY

ANNUAL

LOCATIONS

TAX DUE

CODE

(a)

(b)

(c)

(d)

(e)

(f)

RETAIL

Liquors (Distilled spirits, wine or beer)

$20.83 1/3

$250

11

DEALER

Beer only

$20.83 1/3

250

12

Liquors (Distilled Spirits, Wine or Beer) - at large

$20.83 1/3

250

15

Beer only - at large

$20.83 1/3

250

16

WHOLESALE

Distilled spirits, wine or beer

$41.66 2/3

500

31

DEALER

Beer only

$41.66 2/3

500

32

BREWER

Regular rate

$83.33 1/3

1000

41

REDUCED rate*

$41.66 2/3

500

43*

NONBEVERAGE DRAWBACK CLAIMANT

500

51

INDUSTRIAL

$20.83 1/3

250

55

User of specially denatured alcohol

ALCOHOL

$20.83 1/3

250

56

Dealer in specially denatured alcohol

$20.83 1/3

250

57

User of tax-free alcohol

ALCOHOL

$83.33 1/3

1000

58

Proprietor of alcohol fuel plant

PRODUCERS

$41.66 2/3

500

59*

Proprietor of alcohol fuel plant - REDUCED*

$83.33 1/3

1000

81

Proprietor of distilled spirits plant

$41.66 2/3

500

86*

Proprietor of distilled spirits plant - REDUCED*

$83.33 1/3

1000

82

Proprietor of bonded wine cellar

$41.66 2/3

500

87*

Proprietor of bonded wine cellar - REDUCED*

$83.33 1/3

1000

83

Proprietor of bonded wine warehouse

$41.66 2/3

500

88*

Proprietor of bonded wine warehouse - REDUCED*

$83.33 1/3

1000

84

Proprietor of tax paid wine bottling house

$41.66 2/3

500

89*

Proprietor of tax paid wine bottling house - REDUCED*

$83.33 1/3

1000

91

Manufacturer of tobacco products

TOBACCO

$41.66 2/3

500

95*

Manufacturer of tobacco products - REDUCED*

PRODUCTS

$83.33 1/3

1000

92

Manufacturer of cigarette papers and tubes

$41.66 2/3

500

96*

Manufacturer of cigarette papers and tubes - REDUCED*

$83.33 1/3

1000

93

Proprietor of export warehouse

$41.66 2/3

500

97*

Proprietor of export warehouse - REDUCED*

MAKE CHECK OR MONEY ORDER PAYABLE TO "BUREAU OF ALCOHOL, TOBACCO AND

TOTAL TAX DUE $

0.00

FIREARMS", WRITE YOUR EMPLOYER IDENTIFICATION NUMBER ON THE CHECK AND SEND IT

WITH THE RETURN TO BUREAU OF ATF, P.O. BOX 371962, PITTSBURG, PA 15250-7962.

Under penalties of perjury, I declare that the statements in this return/registration are true and correct to the best of my knowledge and belief; that this

return/registration applies only to the specified business and location or, where the return/registration is for more than one location, it applies only to the

businesses at the locations specified on the attached list. Note: Violation of Title 26, United States Code 7206, is punishable upon conviction by a fine of not

more than $100,000 ($500,000 in the case of a corporation) or imprisonment for not more than 3 years, or both, with the costs of prosecution added thereto.

SIGNATURE

TITLE

DATE

ATF F 5630.5 (10-99) PREVIOUS EDITIONS ARE OBSOLETE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2