Amusement Tax Exemption Notification Form - City Of Chicago Department Of Revenue

ADVERTISEMENT

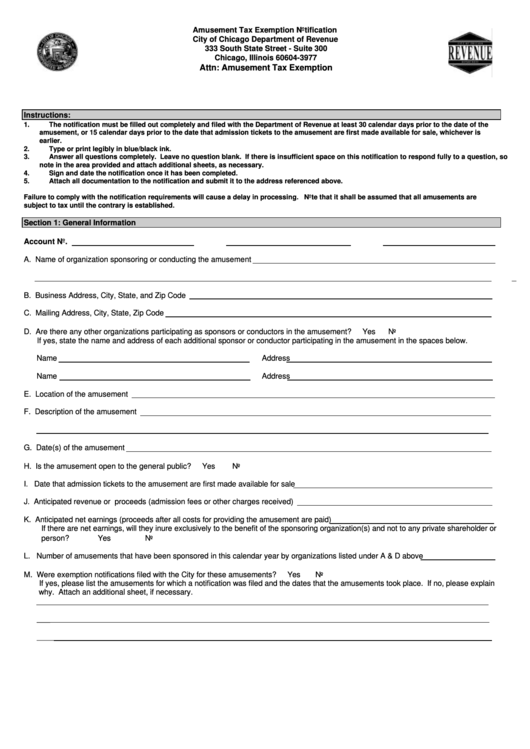

Amusement Tax Exemption Notification

City of Chicago Department of Revenue

333 South State Street - Suite 300

Chicago, Illinois 60604-3977

Attn: Amusement Tax Exemption

Instructions:

1.

The notification must be filled out completely and filed with the Department of Revenue at least 30 calendar days prior to the date of the

amusement, or 15 calendar days prior to the date that admission tickets to the amusement are first made available for sale, whichever is

earlier.

2.

Type or print legibly in blue/black ink.

3.

Answer all questions completely. Leave no question blank. If there is insufficient space on this notification to respond fully to a question, so

note in the area provided and attach additional sheets, as necessary.

4.

Sign and date the notification once it has been completed.

5.

Attach all documentation to the notification and submit it to the address referenced above.

Failure to comply with the notification requirements will cause a delay in processing. Note that it shall be assumed that all amusements are

subject to tax until the contrary is established.

Section 1: General Information

Account No.

F.E.I.N.

I.B.T.N.

A. Name of organization sponsoring or conducting the amusement

_

B. Business Address, City, State, and Zip Code

C. Mailing Address, City, State, Zip Code

D. Are there any other organizations participating as sponsors or conductors in the amusement?

Yes

No

If yes, state the name and address of each additional sponsor or conductor participating in the amusement in the spaces below.

Name

Address

Name

Address

E. Location of the amusement

F. Description of the amusement

G. Date(s) of the amusement

H. Is the amusement open to the general public?

Yes

No

I. Date that admission tickets to the amusement are first made available for sale

J. Anticipated revenue or proceeds (admission fees or other charges received)

K. Anticipated net earnings (proceeds after all costs for providing the amusement are paid)

If there are net earnings, will they inure exclusively to the benefit of the sponsoring organization(s) and not to any private shareholder or

person?

Yes

No

L. Number of amusements that have been sponsored in this calendar year by organizations listed under A & D above

M. Were exemption notifications filed with the City for these amusements?

Yes

No

If yes, please list the amusements for which a notification was filed and the dates that the amusements took place. If no, please explain

why. Attach an additional sheet, if necessary.

___

____

___

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2