Personal Property Listing Form 2011 - Henderson County Tax Department

ADVERTISEMENT

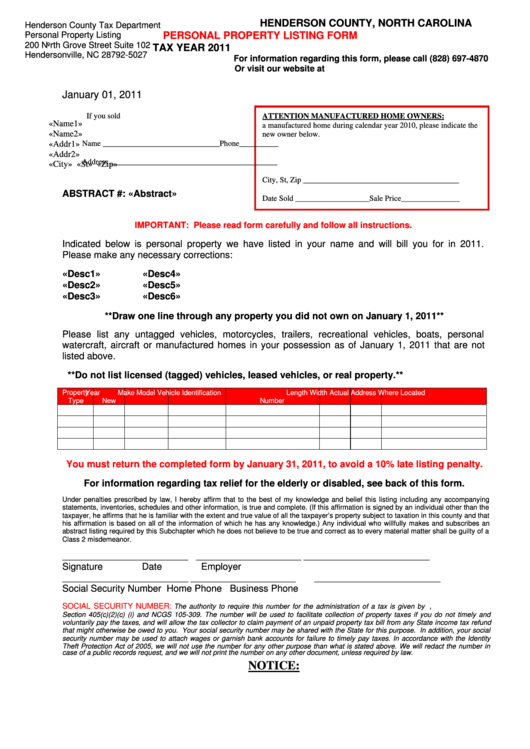

HENDERSON COUNTY, NORTH CAROLINA

Henderson County Tax Department

PERSONAL PROPERTY LISTING FORM

Personal Property Listing

200 North Grove Street Suite 102

TAX YEAR 2011

Hendersonville, NC 28792-5027

For information regarding this form, please call (828) 697-4870

Or visit our website at

January 01, 2011

ATTENTION MANUFACTURED HOME OWNERS:

If you sold

«Name1»

a manufactured home during calendar year 2010, please indicate the

«Name2»

new owner below.

Name ______________________________Phone__________

«Addr1»

«Addr2»

Address ___________________________________________

«City» «St» «Zip»

City, St, Zip ________________________________________

ABSTRACT #: «Abstract»

Date Sold ___________________Sale Price_______________

IMPORTANT: Please read form carefully and follow all instructions.

Indicated below is personal property we have listed in your name and will bill you for in 2011.

Please make any necessary corrections:

«Desc1»

«Desc4»

«Desc2»

«Desc5»

«Desc3»

«Desc6»

**Draw one line through any property you did not own on January 1, 2011**

Please list any untagged vehicles, motorcycles, trailers, recreational vehicles, boats, personal

watercraft, aircraft or manufactured homes in your possession as of January 1, 2011 that are not

listed above.

**Do not list licensed (tagged) vehicles, leased vehicles, or real property.**

Property

Year

Make

Model

Vehicle Identification

Length

Width

Actual Address Where Located

Type

New

Number

You must return the completed form by January 31, 2011, to avoid a 10% late listing penalty.

For information regarding tax relief for the elderly or disabled, see back of this form.

Under penalties prescribed by law, I hereby affirm that to the best of my knowledge and belief this listing including any accompanying

statements, inventories, schedules and other information, is true and complete. (If this affirmation is signed by an individual other than the

taxpayer, he affirms that he is familiar with the extent and true value of all the taxpayer’s property subject to taxation in this county and that

his affirmation is based on all of the information of which he has any knowledge.) Any individual who willfully makes and subscribes an

abstract listing required by this Subchapter which he does not believe to be true and correct as to every material matter shall be guilty of a

Class 2 misdemeanor.

________________________

____________________

________________________

Signature

Date

Employer

________________________

____________________

________________________

Social Security Number

Home Phone

Business Phone

SOCIAL SECURITY NUMBER:

The authority to require this number for the administration of a tax is given by U.S. Code Title 42,

Section 405(c)(2)(c) (i) and NCGS 105-309. The number will be used to facilitate collection of property taxes if you do not timely and

voluntarily pay the taxes, and will allow the tax collector to claim payment of an unpaid property tax bill from any State income tax refund

that might otherwise be owed to you. Your social security number may be shared with the State for this purpose. In addition, your social

security number may be used to attach wages or garnish bank accounts for failure to timely pay taxes. In accordance with the Identity

Theft Protection Act of 2005, we will not use the number for any other purpose than what is stated above. We will redact the number in

case of a public records request, and we will not print the number on any other document, unless required by law.

NOTICE:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2