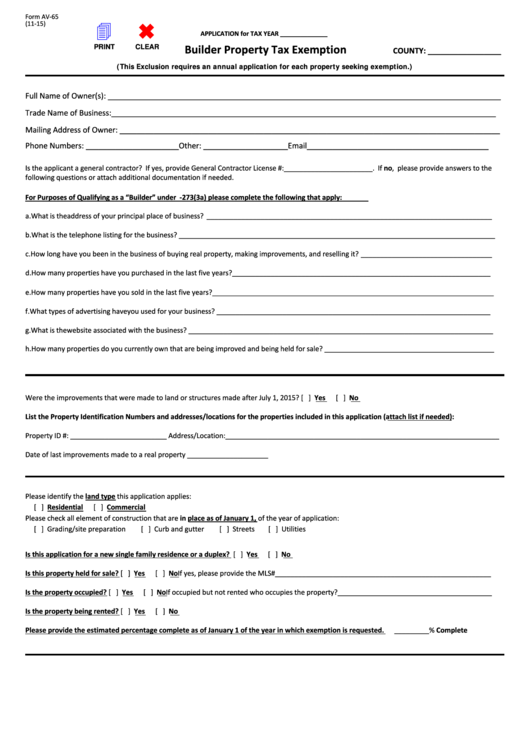

Form AV-65

4

(11-15)

APPLICATION for TAX YEAR ______________

Builder Property Tax Exemption

PRINT

CLEAR

COUNTY: _________________

(This Exclusion requires an annual application for each property seeking exemption.)

Full Name of Owner(s): _____________________________________________________________________________________________

Trade Name of Business: ___________________________________________________________________________________________

Mailing Address of Owner: __________________________________________________________________________________________

Phone Numbers: ______________________ Other: ____________________ Email ___________________________________________

Is the applicant a general contractor? If yes, provide General Contractor License #:_______________________. If no, please provide answers to the

following questions or attach additional documentation if needed.

For Purposes of Qualifying as a “Builder” under G.S. 105-273(3a) please complete the following that apply:

a.

What is the address of your principal place of business? __________________________________________________________________________

b.

What is the telephone listing for the business? __________________________________________________________________________________

c.

How long have you been in the business of buying real property, making improvements, and reselling it? __________________________________

d.

How many properties have you purchased in the last five years? ___________________________________________________________________

e.

How many properties have you sold in the last five years?_________________________________________________________________________

f.

What types of advertising have you used for your business? _______________________________________________________________________

g.

What is the website associated with the business? _______________________________________________________________________________

h.

How many properties do you currently own that are being improved and being held for sale? ____________________________________________

Were the improvements that were made to land or structures made after July 1, 2015? [ ] Yes

[ ] No

List the Property Identification Numbers and addresses/locations for the properties included in this application (attach list if needed):

Property ID #: _________________________ Address/Location:_______________________________________________________________________

Date of last improvements made to a real property _____________________

Please identify the land type this application applies:

[ ] Residential

[ ] Commercial

Please check all element of construction that are in place as of January 1, of the year of application:

[ ] Grading/site preparation

[ ] Curb and gutter

[ ] Streets

[ ] Utilities

Is this application for a new single family residence or a duplex? [ ] Yes

[ ] No

Is this property held for sale? [ ] Yes

[ ] No If yes, please provide the MLS#________________________________________________________

Is the property occupied? [ ] Yes

[ ] No If occupied but not rented who occupies the property?________________________________________

Is the property being rented? [ ] Yes

[ ] No

Please provide the estimated percentage complete as of January 1 of the year in which exemption is requested.

_________% Complete

1

1 2

2