Danville Income Tax Return Form - Ncome Tax Department

ADVERTISEMENT

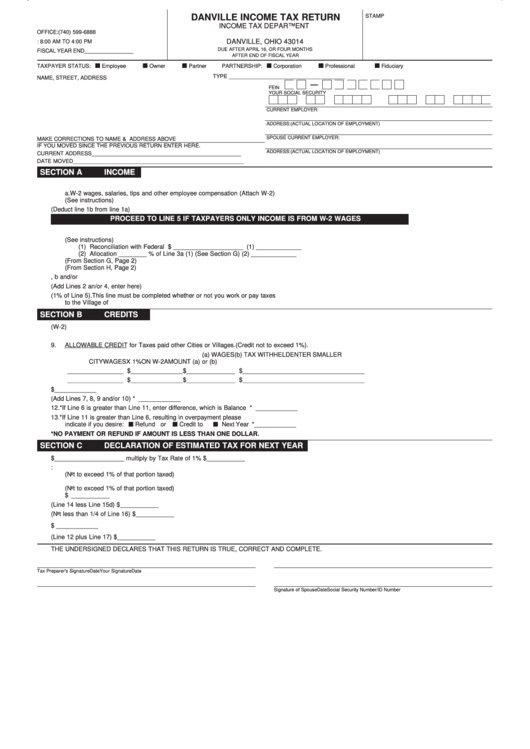

DANVILLE INCOME TAX RETURN

STAMP

INCOME TAX DEPARTMENT

OFFICE: (740) 599-6888

P.O. BOX 51

DANVILLE, OHIO 43014

MON. THRU FRI.: 8:00 AM TO 4:00 PM

DUE AFTER APRIL 16, OR FOUR MONTHS

FISCAL YEAR END________________

AFTER END OF FISCAL YEAR

TAXPAYER STATUS:

Employee

Owner

Partner

PARTNERSHIP:

Corporation

Professional

Fiduciary

TYPE ______________________________________

NAME, STREET, ADDRESS

FEIN

YOUR SOCIAL SECURITY NO.

SPOUSE SOCIAL SECURITY NO.

CURRENT EMPLOYER:

ADDRESS: (ACTUAL LOCATION OF EMPLOYMENT)

SPOUSE CURRENT EMPLOYER:

MAKE CORRECTIONS TO NAME & ADDRESS ABOVE

IF YOU MOVED SINCE THE PREVIOUS RETURN ENTER HERE.

ADDRESS: (ACTUAL LOCATION OF EMPLOYMENT)

CURRENT ADDRESS _________________________________________________

DATE MOVED ________________________________________________________

SECTION A

INCOME

1.

Types of incomes

a.

W-2 wages, salaries, tips and other employee compensation (Attach W-2).......................................................................................... a. _____________

b.

Partial year income (See instructions)................................................................................................................... b. _____________

2.

TOTAL INCOME (Deduct line 1b from line 1a) .............................................................................................................................................. 2. _____________

PROCEED TO LINE 5 IF TAXPAYERS ONLY INCOME IS FROM W-2 WAGES

3.

OTHER INCOME

a.

Profit or loss from income other than wages. (See instructions) ........................................................................... a. _____________

(1) Reconciliation with Federal Return....$ ____________________ ................................................................. (1) _____________

(2) Allocation ________ % of Line 3a (1) (See Section G) .................................................................................. (2) _____________

b.

Rental Income (From Section G, Page 2) ............................................................................................................. b. _____________

c.

Other Income (From Section H, Page 2) ............................................................................................................... c. _____________

4.

TOTAL LINES 3a, b and/or c.......................................................................................................................................................................... 4. ____________

5.

TOTAL INCOME (Add Lines 2 an/or 4, enter here) ....................................................................................................................................... 5. ____________

6.

Danville income tax (1% of Line 5). This line must be completed whether or not you work or pay taxes

to the Village of Danville................................................................................................................................................................................. 6. ____________

SECTION B

CREDITS

7.

Tax withheld by employer for Danville (W-2).................................................................................................................. 7. _____________

8.

Estimated Tax paid to Danville....................................................................................................................................... 8. _____________

9.

ALLOWABLE CREDIT for Taxes paid other Cities or Villages. (Credit not to exceed 1%).

(a) WAGES

(b) TAX WITHHELD

ENTER SMALLER

CITY

WAGES

X 1%

ON W-2

AMOUNT (a) or (b)

________________ $ _______________ $ ______________ $ __________________

_________________

________________ $ _______________ $ ______________ $ __________________

_________________

10. Prior Overpayment......................................................................................................................................................... 10. $____________

11. TOTAL CREDITS (Add Lines 7, 8, 9 and/or 10) ............................................................................................................................................11.* ____________

12.* If Line 6 is greater than Line 11, enter difference, which is Balance Due. Make check payable to Village of Danville.................................12.* ____________

13.* If Line 11 is greater than Line 6, resulting in overpayment please

indicate if you desire:

Refund or

Credit to

Next Year Tax. .............................................................................................................13.* ____________

*NO PAYMENT OR REFUND IF AMOUNT IS LESS THAN ONE DOLLAR.

SECTION C

DECLARATION OF ESTIMATED TAX FOR NEXT YEAR

14. Total income subject to Tax $____________________ multiply by Tax Rate of 1% ..................................................................................... 14. $ ___________

15. Less expected Tax Credit:

a.

Withheld by an employer (Not to exceed 1% of that portion taxed) ...................................................................... a. _____________

b.

Overpayment from prior year................................................................................................................................. b. _____________

c.

Payments to another municipality (Not to exceed 1% of that portion taxed)......................................................... c. _____________

d.

TOTAL CREDITS.................................................................................................................................................................................... d. $ ___________

16. NET TAX DUE (Line 14 less Line 15d) .......................................................................................................................................................... 16. $ ___________

17. Amount Paid with this declaration (Not less than 1/4 of Line 16) .................................................................................................................. 17. $ ___________

18. Balance of Tax Due........................................................................................................................................................18. $ ____________

19. Total of this Payment (Line 12 plus Line 17) .................................................................................................................................................. 19. $ ___________

THE UNDERSIGNED DECLARES THAT THIS RETURN IS TRUE, CORRECT AND COMPLETE.

Tax Preparer's Signature

Date

Your Signature

Date

Social Security Number/ID Number

Signature of Spouse

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2