Request For Existing Sales And Use Tax Exemption Form

ADVERTISEMENT

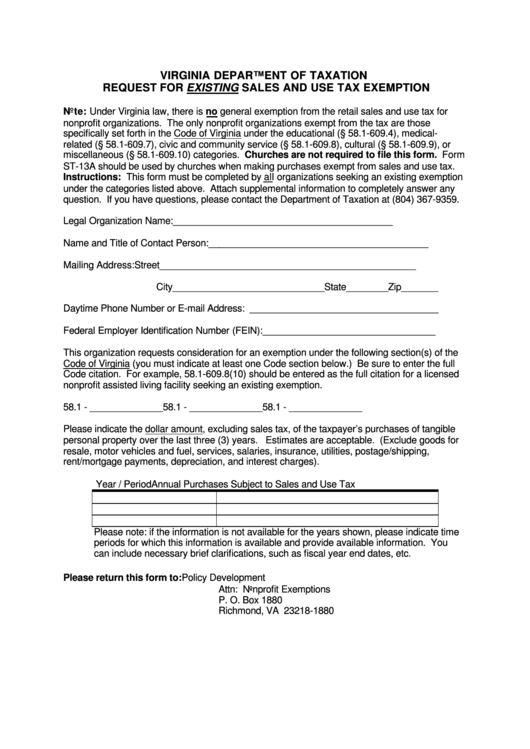

VIRGINIA DEPARTMENT OF TAXATION

REQUEST FOR EXISTING SALES AND USE TAX EXEMPTION

Note: Under Virginia law, there is no general exemption from the retail sales and use tax for

nonprofit organizations. The only nonprofit organizations exempt from the tax are those

specifically set forth in the Code of Virginia under the educational (§ 58.1-609.4), medical-

related (§ 58.1-609.7), civic and community service (§ 58.1-609.8), cultural (§ 58.1-609.9), or

miscellaneous (§ 58.1-609.10) categories. Churches are not required to file this form. Form

ST-13A should be used by churches when making purchases exempt from sales and use tax.

Instructions: This form must be completed by all organizations seeking an existing exemption

under the categories listed above. Attach supplemental information to completely answer any

question. If you have questions, please contact the Department of Taxation at (804) 367-9359.

Legal Organization Name:

__________________________________________

Name and Title of Contact Person: __________________________________________

Mailing Address:

Street_________________________________________________

City_____________________________State________Zip_______

Daytime Phone Number or E-mail Address: ____________________________________

Federal Employer Identification Number (FEIN):_________________________________

This organization requests consideration for an exemption under the following section(s) of the

Code of Virginia (you must indicate at least one Code section below.) Be sure to enter the full

Code citation. For example, 58.1-609.8(10) should be entered as the full citation for a licensed

nonprofit assisted living facility seeking an existing exemption.

58.1 - ______________

58.1 - ______________

58.1 - ______________

Please indicate the dollar amount, excluding sales tax, of the taxpayer’s purchases of tangible

personal property over the last three (3) years. Estimates are acceptable. (Exclude goods for

resale, motor vehicles and fuel, services, salaries, insurance, utilities, postage/shipping,

rent/mortgage payments, depreciation, and interest charges).

Year / Period

Annual Purchases Subject to Sales and Use Tax

Please note: if the information is not available for the years shown, please indicate time

periods for which this information is available and provide available information. You

can include necessary brief clarifications, such as fiscal year end dates, etc.

Please return this form to:

Policy Development

Attn: Nonprofit Exemptions

P. O. Box 1880

Richmond, VA 23218-1880

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1