WEB

RETURN THIS ENTIRE SHEET WITH YOUR PAYMENT

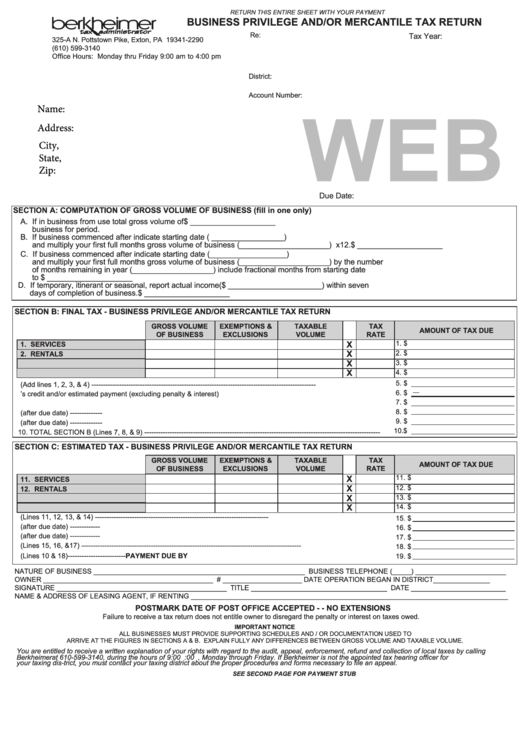

BUSINESS PRIVILEGE AND/OR MERCANTILE TAX RETURN

Tax Year:

Re:

325-A N. Pottstown Pike, Exton, PA 19341-2290

(610) 599-3140

Office Hours: Monday thru Friday 9:00 am to 4:00 pm

District:

Account Number:

Name:

Address:

City,

State,

Zip:

Due Date:

SECTION A: COMPUTATION OF GROSS VOLUME OF BUSINESS (fill in one only)

A. If in business from

use total gross volume of

$ ____________________

business for period.

B. If business commenced after

indicate starting date ( _________________)

and multiply your first full months gross volume of business (_____________________) x12.

$ ____________________

C. If business commenced after

indicate starting date (__________________)

and multiply your first full months gross volume of business (_____________________) by the number

of months remaining in year (___________________) include fractional months from starting date

to

$ ____________________

D. If temporary, itinerant or seasonal, report actual income

($ ______________________) within seven

days of completion of business.

$ ____________________

SECTION B: FINAL TAX - BUSINESS PRIVILEGE AND/OR MERCANTILE TAX RETURN

GROSS VOLUME

EXEMPTIONS &

TAXABLE

TAX

AMOUNT OF TAX DUE

OF BUSINESS

EXCLUSIONS

VOLUME

RATE

X

1. $

1. SERVICES

X

2. $

2. RENTALS

X

3. RETAIL BUSINESS

3. $

X

4. WHOLESALE BUSINESS

4. $

5. $

5. TOTAL TAX DUE (Add lines 1, 2, 3, & 4) -------------------------------------------------------------------------------------------------

6. $

6. Less last year’s credit and/or estimated payment (excluding penalty & interest)

7. $

7. SUBTOTAL ----------------------------------------------------------------------------------------------------------------------------------------

8. $

8. Add interest of

(after due date) --------------

9. $

9. Add penalty of

(after due date) --------------

10.$

10. TOTAL SECTION B (Lines 7, 8, & 9) ------------------------------------------------------------------------------------------------------

SECTION C: ESTIMATED TAX - BUSINESS PRIVILEGE AND/OR MERCANTILE TAX RETURN

GROSS VOLUME

EXEMPTIONS &

TAXABLE

TAX

AMOUNT OF TAX DUE

EXCLUSIONS

OF BUSINESS

VOLUME

RATE

X

11. $

11. SERVICES

X

12. $

12. RENTALS

X

13. $

13. RETAIL BUSINESS

X

14. $

14. WHOLESALE BUSINESS

15. TOTAL ESTIMATED TAX DUE (Lines 11, 12, 13, & 14) ---------------------------------------------------------------------------

15. $

16. Add interest of

(after due date) -------------

16. $

17. Add penalty of

(after due date) -------------

17. $

18. TOTAL SECTION C (Lines 15, 16, &17) -----------------------------------------------------------------------------------------------

18. $

19. TOTAL AMOUNT DUE (Lines 10 & 18)------------------------- PAYMENT DUE BY

19. $

NATURE OF BUSINESS ________________________________________________________ BUSINESS TELEPHONE (_____) ________________________

OWNER _____________________________________________ E.I.N. # _____________________ DATE OPERATION BEGAN IN DISTRICT_______________

SIGNATURE _____________________________________________ TITLE ____________________________________ DATE _________________________

NAME & ADDRESS OF LEASING AGENT, IF RENTING ____________________________________________________________________________________

POSTMARK DATE OF POST OFFICE ACCEPTED - - NO EXTENSIONS

Failure to receive a tax return does not entitle owner to disregard the penalty or interest on taxes owed.

IMPORTANT NOTICE

ALL BUSINESSES MUST PROVIDE SUPPORTING SCHEDULES AND / OR DOCUMENTATION USED TO

ARRIVE AT THE FIGURES IN SECTIONS A & B. EXPLAIN FULLY ANY DIFFERENCES BETWEEN GROSS VOLUME AND TAXABLE VOLUME.

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes by calling

Berkheimer at 610-599-3140, during the hours of 9:00 a.m. through 4:00 p.m., Monday through Friday. If Berkheimer is not the appointed tax hearing officer for

your taxing dis-trict, you must contact your taxing district about the proper procedures and forms necessary to file an appeal.

SEE SECOND PAGE FOR PAYMENT STUB

mercre.qxd

06/15

1

1 2

2