Sales/sellers Use Tax Application And Information Form - Morgan County

ADVERTISEMENT

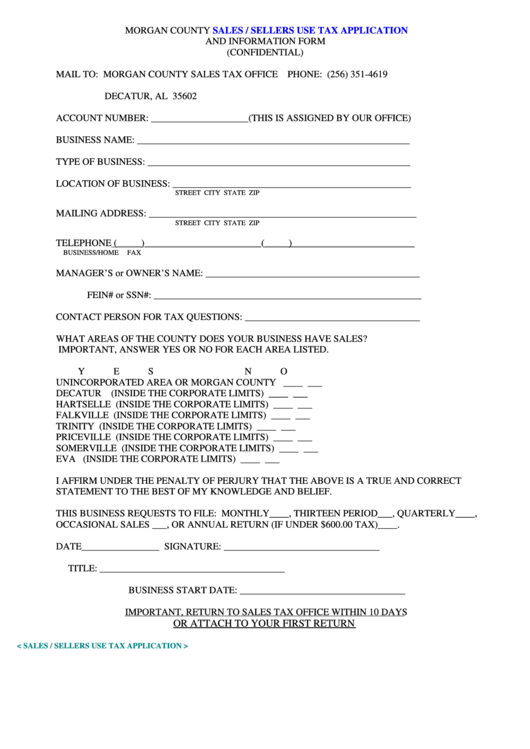

MORGAN COUNTY

SALES / SELLERS USE TAX APPLICATION

AND INFORMATION FORM

(CONFIDENTIAL)

MAIL TO: MORGAN COUNTY SALES TAX OFFICE PHONE: (256) 351-4619

P.O. BOX 1848

DECATUR, AL 35602

ACCOUNT NUMBER: ____________________(THIS IS ASSIGNED BY OUR OFFICE)

BUSINESS NAME: ________________________________________________________

TYPE OF BUSINESS: ______________________________________________________

LOCATION OF BUSINESS: _________________________________________________

STREET

CITY

STATE

ZIP

MAILING ADDRESS: _______________________________________________________

STREET

CITY

STATE

ZIP

TELEPHONE (_____)________________________(_____)__________________________

BUSINESS/HOME

FAX

MANAGER’S or OWNER’S NAME: ____________________________________________

FEIN# or SSN#: _______________________________________________________

CONTACT PERSON FOR TAX QUESTIONS: ____________________________________

WHAT AREAS OF THE COUNTY DOES YOUR BUSINESS HAVE SALES?

IMPORTANT, ANSWER YES OR NO FOR EACH AREA LISTED.

YES

NO

UNINCORPORATED AREA OR MORGAN COUNTY

____

___

DECATUR

(INSIDE THE CORPORATE LIMITS)

____

___

HARTSELLE

(INSIDE THE CORPORATE LIMITS)

____

___

FALKVILLE

(INSIDE THE CORPORATE LIMITS)

____

___

TRINITY

(INSIDE THE CORPORATE LIMITS)

____

___

PRICEVILLE

(INSIDE THE CORPORATE LIMITS)

____

___

SOMERVILLE

(INSIDE THE CORPORATE LIMITS)

____

___

EVA

(INSIDE THE CORPORATE LIMITS)

____

___

I AFFIRM UNDER THE PENALTY OF PERJURY THAT THE ABOVE IS A TRUE AND CORRECT

STATEMENT TO THE BEST OF MY KNOWLEDGE AND BELIEF.

THIS BUSINESS REQUESTS TO FILE: MONTHLY____, THIRTEEN PERIOD___, QUARTERLY____,

OCCASIONAL SALES ___, OR ANNUAL RETURN (IF UNDER $600.00 TAX)____.

DATE________________

SIGNATURE: ________________________________

TITLE: ______________________________________

BUSINESS START DATE: __________________________________

IMPORTANT, RETURN TO SALES TAX OFFICE WITHIN 10 DAYS

OR ATTACH TO YOUR FIRST RETURN

< SALES / SELLERS USE TAX APPLICATION >

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1