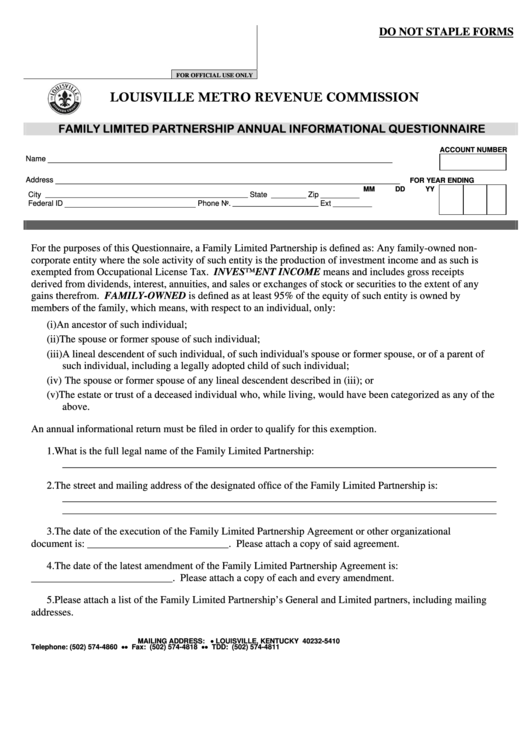

DO NOT STAPLE FORMS

FOR OFFICIAL USE ONLY

LOUISVILLE METRO REVENUE COMMISSION

FAMILY LIMITED PARTNERSHIP ANNUAL INFORMATIONAL QUESTIONNAIRE

ACCOUNT NUMBER

Name

_______________________________________________________________________________

Address

_______________________________________________________________________________

FOR YEAR ENDING

MM

DD

YY

City

____________________________________________________

State

Zip

_________

__________

Federal ID

______________________________

Phone No.

______________________

Ext

__________

For the purposes of this Questionnaire, a Family Limited Partnership is defined as: Any family-owned non-

corporate entity where the sole activity of such entity is the production of investment income and as such is

exempted from Occupational License Tax. INVESTMENT INCOME means and includes gross receipts

derived from dividends, interest, annuities, and sales or exchanges of stock or securities to the extent of any

gains therefrom. FAMILY-OWNED is defined as at least 95% of the equity of such entity is owned by

members of the family, which means, with respect to an individual, only:

(i) An ancestor of such individual;

(ii) The spouse or former spouse of such individual;

(iii)A lineal descendent of such individual, of such individual's spouse or former spouse, or of a parent of

such individual, including a legally adopted child of such individual;

(iv) The spouse or former spouse of any lineal descendent described in (iii); or

(v) The estate or trust of a deceased individual who, while living, would have been categorized as any of the

above.

An annual informational return must be filed in order to qualify for this exemption.

1. What is the full legal name of the Family Limited Partnership:

___________________________________________________________________________________

2. The street and mailing address of the designated office of the Family Limited Partnership is:

___________________________________________________________________________________

___________________________________________________________________________________

3. The date of the execution of the Family Limited Partnership Agreement or other organizational

document is: ___________________________. Please attach a copy of said agreement.

4. The date of the latest amendment of the Family Limited Partnership Agreement is:

___________________________. Please attach a copy of each and every amendment.

5. Please attach a list of the Family Limited Partnership’s General and Limited partners, including mailing

addresses.

MAILING ADDRESS: P.O. BOX 35410 LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 Fax: (502) 574-4818 TDD: (502) 574-4811

1

1 2

2