Form Dr 0589 - Sales Tax Special Event Application

ADVERTISEMENT

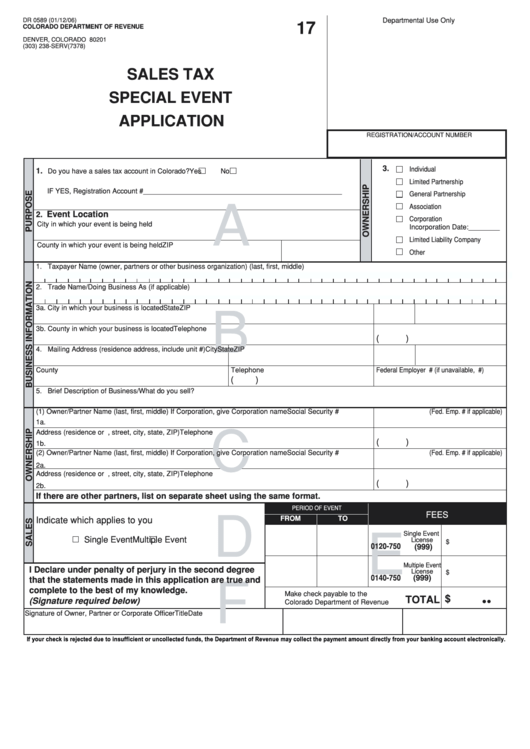

DR 0589 (01/12/06)

Departmental Use Only

17

COLORADO DEPARTMENT OF REVENUE

P.O. BOX 13200

DENVER, COLORADO 80201

(303) 238-SERV(7378)

SALES TAX

SPECIAL EVENT

APPLICATION

REGISTRATION/ACCOUNT NUMBER

3.

Individual

1.

Do you have a sales tax account in Colorado?

Yes

No

Limited Partnership

IF YES, Registration Account # ___________________________________________________

General Partnership

Association

A

Event Location

2.

Corporation

City in which your event is being held

Incorporation Date: ________

Limited Liability Company

County in which your event is being held

ZIP

Other

1. Taxpayer Name (owner, partners or other business organization) (last, first, middle)

2. Trade Name/Doing Business As (if applicable)

3a. City in which your business is located

State

ZIP

B

3b. County in which your business is located

Telephone

(

)

4. Mailing Address (residence address, include unit #)

City

State

ZIP

County

Telephone

Federal Employer I.D. # (if unavailable, S.S.#)

(

)

5. Brief Description of Business/What do you sell?

(1) Owner/Partner Name (last, first, middle) If Corporation, give Corporation name

Social Security # (Fed. Emp. # if applicable)

1a.

Address (residence or P.O. Box, street, city, state, ZIP)

Telephone

C

(

)

1b.

(2) Owner/Partner Name (last, first, middle) If Corporation, give Corporation name

Social Security # (Fed. Emp. # if applicable)

2a.

Address (residence or P.O. Box, street, city, state, ZIP)

Telephone

(

)

2b.

If there are other partners, list on separate sheet using the same format.

PERIOD OF EVENT

FEES

D

FROM

TO

Indicate which applies to you

Single Event

E

Single Event

Multiple Event

License

$

0120-750

(999)

Multiple Event

I Declare under penalty of perjury in the second degree

License

$

0140-750

(999)

that the statements made in this application are true and

F

complete to the best of my knowledge.

Make check payable to the

$

TOTAL

(Signature required below)

• • • • •

Colorado Department of Revenue

Signature of Owner, Partner or Corporate Officer

Title

Date

If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your banking account electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1