Declaration Of Estimated Tax Form

ADVERTISEMENT

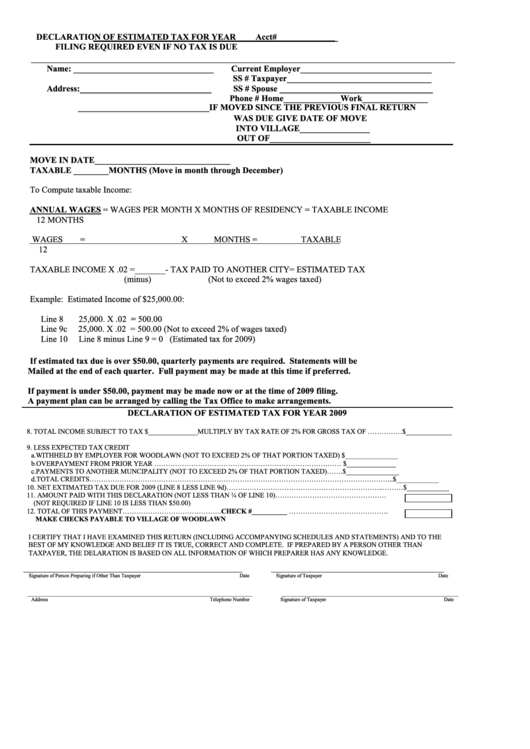

DECLARATION OF ESTIMATED TAX FOR YEAR

Acct#______________

FILING REQUIRED EVEN IF NO TAX IS DUE

_________________________________________________________________________________

Name: ________________________________

Current Employer______________________________

SS # Taxpayer_________________________________

Address:______________________________

SS # Spouse ___________________________________

Phone # Home_____________Work_______________

______________________________

IF MOVED SINCE THE PREVIOUS FINAL RETURN

WAS DUE GIVE DATE OF MOVE

INTO VILLAGE________________

OUT OF_______________________

MOVE IN DATE_______________________________

TAXABLE ________MONTHS (Move in month through December)

To Compute taxable Income:

ANNUAL WAGES = WAGES PER MONTH X MONTHS OF RESIDENCY = TAXABLE INCOME

12 MONTHS

WAGES

=

X

MONTHS =

TAXABLE

12

TAXABLE INCOME X .02 =_______- TAX PAID TO ANOTHER CITY= ESTIMATED TAX

(minus)

(Not to exceed 2% wages taxed)

Example: Estimated Income of $25,000.00:

Line 8

25,000. X .02 = 500.00

Line 9c

25,000. X .02 = 500.00 (Not to exceed 2% of wages taxed)

Line 10

Line 8 minus Line 9 = 0 (Estimated tax for 2009)

If estimated tax due is over $50.00, quarterly payments are required. Statements will be

Mailed at the end of each quarter. Full payment may be made at this time if preferred.

If payment is under $50.00, payment may be made now or at the time of 2009 filing.

A payment plan can be arranged by calling the Tax Office to make arrangements.

DECLARATION OF ESTIMATED TAX FOR YEAR 2009

8. TOTAL INCOME SUBJECT TO TAX $______________MULTIPLY BY TAX RATE OF 2% FOR GROSS TAX OF ……………$_____________

9. LESS EXPECTED TAX CREDIT

a.

WITHHELD BY EMPLOYER FOR WOODLAWN (NOT TO EXCEED 2% OF THAT PORTION TAXED) $_______________

b.

OVERPAYMENT FROM PRIOR YEAR ……………………………………………………………………… $______________

c.

PAYMENTS TO ANOTHER MUNCIPALITY (NOT TO EXCEED 2% OF THAT PORTION TAXED)…….$_______________

d.

TOTAL CREDITS…………………………………………………………………………………………………………………...$____________

10. NET EXTIMATED TAX DUE FOR 2009 (LINE 8 LESS LINE 9d)…………………………………………………………..………$____________

11. AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN ¼ OF LINE 10)…………………………………………

(NOT REQUIRED IF LINE 10 IS LESS THAN $50.00)

12. TOTAL OF THIS PAYMENT…………………………………….CHECK #__________ …………………………………….

MAKE CHECKS PAYABLE TO VILLAGE OF WOODLAWN

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE

BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN

TAXPAYER, THE DELARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

______________________________________________________________

_________________________________________________

Signature of Person Preparing if Other Than Taxpayer

Date

Signature of Taxpayer

Date

____________________________________________________________________________________

__________________________________________________________________

Address

Telephone Number

Signature of Taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1