Form 15g - Declaration Under Section 197a(1) And Section 197a(1a) Page 3

ADVERTISEMENT

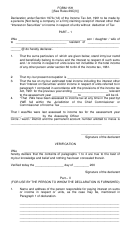

SCHEDULE IV

Name and address

Number of

Class of units

Distinctive

Income in

of the Mutual Fund

units

and face value

number of units

respect of units

of each unit

SCHEDULE V

Particulars of the Post Office

Date on which the

The amount of withdrawal

where the account under the

account was opened

from the account

National Savings Scheme is

maintained and the account

number

________________________.

**Signature of the declarant

Verification

*I / We ______________ do hereby declare that to the best of *my / our knowledge and belief what

is stated above is correct, complete and is truly stated.

Verified today, the day__________ day of ________

Place______________

____________

Signature of the declarant

Note:

1. @ Give complete postal address.

2. The declaration should be furnished in duplicate.

3. *Delete whichever is not applicable.

4. # Declaration in respect of these payments can be furnished by a person (not being a company or a firm).

5. **Indicate the capacity in which the declaration is furnished on behalf of a Hindu undivided family

6. Before signing the verification, the declarant should satisfy himself that the information furnished in the declaration is

true, correct and complete in all respects. Any person making a false statement in the declaration shall be liable to

prosecution under section 277 of the Income-tax Act, 1961, and on conviction be punishable

I)

In a case where tax sought to be evaded exceeds one lakh rupees, with rigorous imprisonment which shall not be less

than six months but which may extend to seven years and with fine;

II) In any other case, with rigorous imprisonment which shall not be less than three months but which may extend to

three years and with fine.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4