Application Form For Appeal Of Property Tax

ADVERTISEMENT

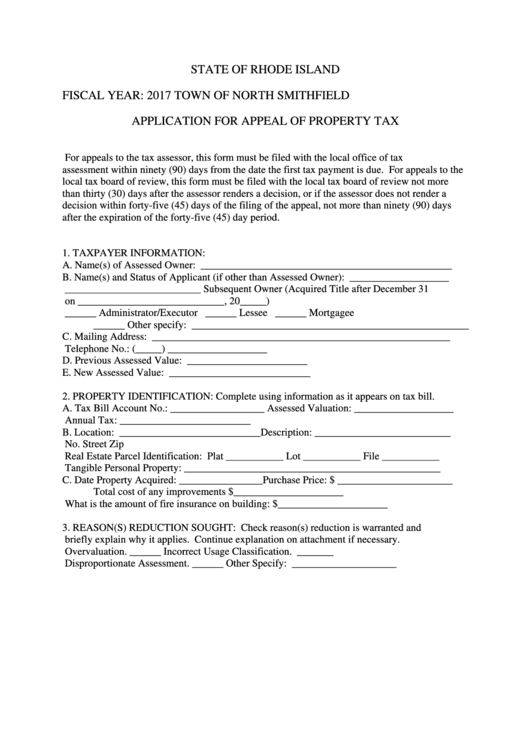

STATE OF RHODE ISLAND

FISCAL YEAR: 2017

TOWN OF NORTH SMITHFIELD

APPLICATION FOR APPEAL OF PROPERTY TAX

For appeals to the tax assessor, this form must be filed with the local office of tax

assessment within ninety (90) days from the date the first tax payment is due. For appeals to the

local tax board of review, this form must be filed with the local tax board of review not more

than thirty (30) days after the assessor renders a decision, or if the assessor does not render a

decision within forty-five (45) days of the filing of the appeal, not more than ninety (90) days

after the expiration of the forty-five (45) day period.

1.

TAXPAYER INFORMATION:

A.

Name(s) of Assessed Owner: ________________________________________________

B.

Name(s) and Status of Applicant (if other than Assessed Owner): ___________________

__________________________ Subsequent Owner (Acquired Title after December 31

on ____________________________, 20_____)

______ Administrator/Executor ______ Lessee ______ Mortgagee

______ Other specify: _____________________________________________________

C.

Mailing Address: _________________________________________________________

Telephone No.: (_____) ___________________

D.

Previous Assessed Value: _______________________

E.

New Assessed Value: ___________________________

2.

PROPERTY IDENTIFICATION: Complete using information as it appears on tax bill.

A.

Tax Bill Account No.: __________________ Assessed Valuation: ___________________

Annual Tax: _________________________

B.

Location: ___________________________Description: __________________________

No.

Street

Zip

Real Estate Parcel Identification: Plat ___________ Lot ___________ File ___________

Tangible Personal Property: _________________________________________________

C.

Date Property Acquired: ________________Purchase Price: $ ______________________

Total cost of any improvements $_____________________

What is the amount of fire insurance on building: $_____________________

3.

REASON(S) REDUCTION SOUGHT: Check reason(s) reduction is warranted and

briefly explain why it applies. Continue explanation on attachment if necessary.

Overvaluation. ______

Incorrect Usage Classification. _______

Disproportionate Assessment. ______

Other Specify: ____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3