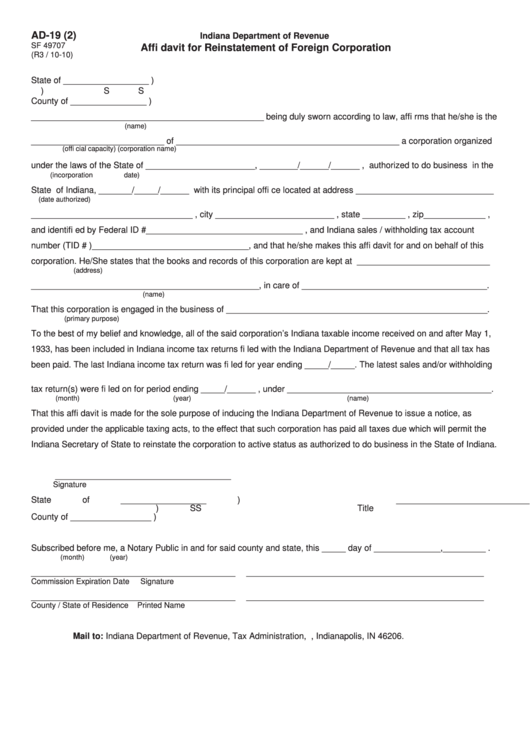

AD-19 (2)

Indiana Department of Revenue

SF 49707

Affi davit for Reinstatement of Foreign Corporation

(R3 / 10-10)

State of __________________ )

) SS

County of ________________ )

_________________________________________________ being duly sworn according to law, affi rms that he/she is the

(name)

____________________________ of _______________________________________________ a corporation organized

(offi cial capacity)

(corporation name)

under the laws of the State of _______________________, ________/______/______ , authorized to do business in the

(incorporation date)

State of Indiana, _______/_____/______ with its principal offi ce located at address _____________________________

(date authorized)

__________________________________ , city _________________________ , state _________ , zip_____________ ,

and identifi ed by Federal ID #_________________________________ , and Indiana sales / withholding tax account

number (TID # )_________________________________, and that he/she makes this affi davit for and on behalf of this

corporation. He/She states that the books and records of this corporation are kept at ____________________________

(address)

________________________________________________, in care of _______________________________________.

(name)

That this corporation is engaged in the business of _______________________________________________________.

(primary purpose)

To the best of my belief and knowledge, all of the said corporation’s Indiana taxable income received on and after May 1,

1933, has been included in Indiana income tax returns fi led with the Indiana Department of Revenue and that all tax has

been paid. The last Indiana income tax return was fi led for year ending _____/_____. The latest sales and/or withholding

(month) (year)

tax return(s) were fi led on for period ending _____/______ , under ___________________________________________.

(month) (year)

(name)

That this affi davit is made for the sole purpose of inducing the Indiana Department of Revenue to issue a notice, as

provided under the applicable taxing acts, to the effect that such corporation has paid all taxes due which will permit the

Indiana Secretary of State to reinstate the corporation to active status as authorized to do business in the State of Indiana.

_____________________________________

Signature

State of __________________ )

_____________________________________

) SS

Title

County of _________________ )

Subscribed before me, a Notary Public in and for said county and state, this _____ day of ______________,_________ .

(month)

(year)

___________________________________________

__________________________________________________

Commission Expiration Date

Signature

___________________________________________

__________________________________________________

County / State of Residence

Printed Name

Mail to: Indiana Department of Revenue, Tax Administration, P.O. Box 6197, Indianapolis, IN 46206.

1

1