Form 301 Notice Under Sub- Section (2),(3) Or (4)of Section 23 Of The Maharashtra Value Added Tax Act,2002

ADVERTISEMENT

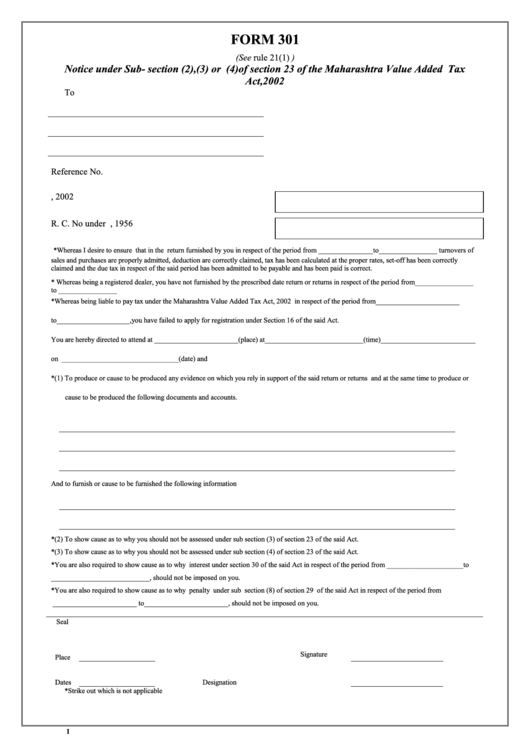

FORM 301

(See rule 21(1) )

Notice under Sub- section (2),(3) or (4)of section 23 of the Maharashtra Value Added Tax

Act,2002

To

Reference No.

R.C. No. under M.V.A.T. Act, 2002

R. C. No under C.S.T. Act, 1956

ü

*Whereas I desire to ensure that in the return furnished by you in respect of the period from _______________to________________ turnovers of

sales and purchases are properly admitted, deduction are correctly claimed, tax has been calculated at the proper rates, set-off has been correctly

claimed and the due tax in respect of the said period has been admitted to be payable and has been paid is correct.

* Whereas being a registered dealer, you have not furnished by the prescribed date return or returns in respect of the period from________________

to ________________

*Whereas being liable to pay tax under the Maharashtra Value Added Tax Act, 2002 in respect of the period from_______________________

to____________________,you have failed to apply for registration under Section 16 of the said Act.

You are hereby directed to attend at _______________________(place) at___________________________(time)__________________________

on ________________________________(date) and

*(1) To produce or cause to be produced any evidence on which you rely in support of the said return or returns and at the same time to produce or

cause to be produced the following documents and accounts.

And to furnish or cause to be furnished the following information

*(2) To show cause as to why you should not be assessed under sub section (3) of section 23 of the said Act.

*(3) To show cause as to why you should not be assessed under sub section (4) of section 23 of the said Act.

*You are also required to show cause as to why interest under section 30 of the said Act in respect of the period from _____________________to

___________________________, should not be imposed on you.

*You are also required to show cause as to why penalty under sub section (8) of section 29 of the said Act in respect of the period from

_______________________ to_______________________, should not be imposed on you.

Seal

Signature

Place

Dates

Designation

*Strike out which is not applicable

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1