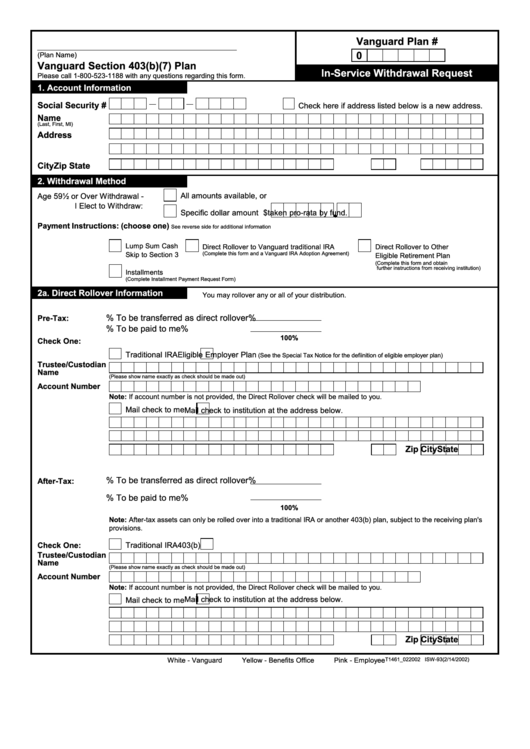

Vanguard Section 403(B)(7) Plan Template

ADVERTISEMENT

Vanguard Plan #

0

(Plan Name)

Vanguard Section 403(b)(7) Plan

In-Service Withdrawal Request

Please call 1-800-523-1188 with any questions regarding this form.

1. Account Information

Social Security #

Check here if address listed below is a new address.

Name

(Last, First, MI)

Address

City

State

Zip

2. Withdrawal Method

All amounts available, or

Age 59½ or Over Withdrawal -

I Elect to Withdraw:

Specific dollar amount $

taken pro-rata by fund.

Payment Instructions: (choose one)

See reverse side for additional information

Lump Sum Cash

Direct Rollover to Vanguard traditional IRA

Direct Rollover to Other

Skip to Section 3

(Complete this form and a Vanguard IRA Adoption Agreement)

Eligible Retirement Plan

(Complete this form and obtain

further instructions from receiving institution)

Installments

(Complete Installment Payment Request Form)

2a. Direct Rollover Information

You may rollover any or all of your distribution.

% To be transferred as direct rollover

%

Pre-Tax:

% To be paid to me

%

100%

Check One:

Traditional IRA

Eligible Employer Plan

(See the Special Tax Notice for the defiinition of eligible employer plan)

Trustee/Custodian

Name

(Please show name exactly as check should be made out)

Account Number

Note: If account number is not provided, the Direct Rollover check will be mailed to you.

Mail check to me

Mail check to institution at the address below.

City

State

Zip

% To be transferred as direct rollover

%

After-Tax:

% To be paid to me

%

100%

Note: After-tax assets can only be rolled over into a traditional IRA or another 403(b) plan, subject to the receiving plan's

provisions.

403(b)

Check One:

Traditional IRA

Trustee/Custodian

Name

(Please show name exactly as check should be made out)

Account Number

Note: If account number is not provided, the Direct Rollover check will be mailed to you.

Mail check to institution at the address below.

Mail check to me

City

State

Zip

(2/14/2002)

White - Vanguard

Yellow - Benefits Office

Pink - Employee

T1461_022002 ISW-93

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3