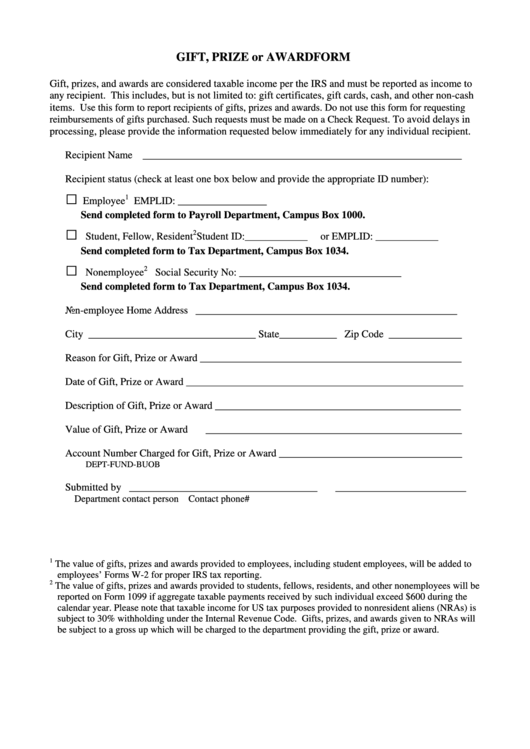

GIFT, PRIZE or AWARD FORM

Gift, prizes, and awards are considered taxable income per the IRS and must be reported as income to

any recipient. This includes, but is not limited to: gift certificates, gift cards, cash, and other non-cash

items. Use this form to report recipients of gifts, prizes and awards. Do not use this form for requesting

reimbursements of gifts purchased. Such requests must be made on a Check Request. To avoid delays in

processing, please provide the information requested below immediately for any individual recipient.

Recipient Name _____________________________________________________________

Recipient status (check at least one box below and provide the appropriate ID number):

□

1

Employee

EMPLID: _________________

Send completed form to Payroll Department, Campus Box 1000.

□

2

Student, Fellow, Resident

Student ID:____________

or EMPLID: ____________

Send completed form to Tax Department, Campus Box 1034.

□

2

Nonemployee

Social Security No: _______________________________

Send completed form to Tax Department, Campus Box 1034.

Non-employee Home Address __________________________________________________

City ________________________________ State___________ Zip Code ______________

Reason for Gift, Prize or Award __________________________________________________

Date of Gift, Prize or Award _____________________________________________________

Description of Gift, Prize or Award _______________________________________________

Value of Gift, Prize or Award

_________________________________________________

Account Number Charged for Gift, Prize or Award ___________________________________

DEPT-FUND-BUOB

Submitted by ____________________________________

_________________________

Department contact person

Contact phone#

1

The value of gifts, prizes and awards provided to employees, including student employees, will be added to

employees’ Forms W-2 for proper IRS tax reporting.

2

The value of gifts, prizes and awards provided to students, fellows, residents, and other nonemployees will be

reported on Form 1099 if aggregate taxable payments received by such individual exceed $600 during the

calendar year. Please note that taxable income for US tax purposes provided to nonresident aliens (NRAs) is

subject to 30% withholding under the Internal Revenue Code. Gifts, prizes, and awards given to NRAs will

be subject to a gross up which will be charged to the department providing the gift, prize or award.

1

1