Form Dr 0589 - Sales Tax Special Event Application - Departament Of Revenue, State Of Colorado

ADVERTISEMENT

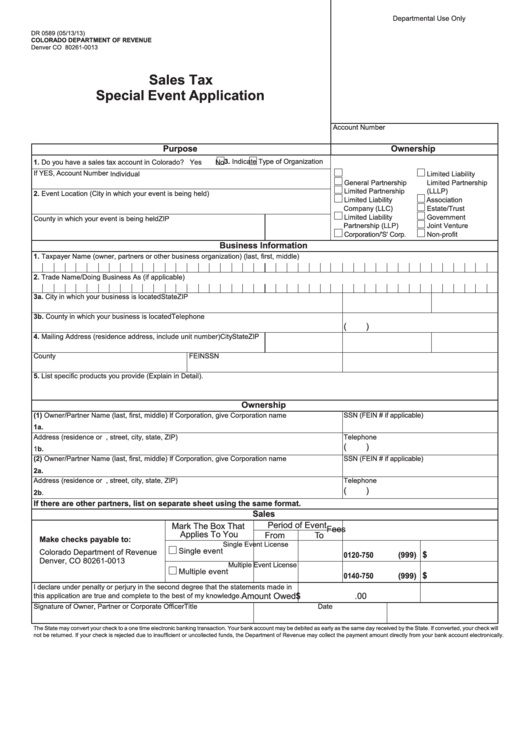

Departmental Use Only

DR 0589 (05/13/13)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

Sales Tax

Special Event Application

Account Number

Purpose

Ownership

3. Indicate Type of Organization

1. Do you have a sales tax account in Colorado?

Yes

No

If YES, Account Number

Individual

Limited Liability

General Partnership

Limited Partnership

Limited Partnership

(LLLP)

2. Event Location (City in which your event is being held)

Limited Liability

Association

Company (LLC)

Estate/Trust

Limited Liability

Government

County in which your event is being held

ZIP

Partnership (LLP)

Joint Venture

Corporation/'S' Corp.

Non-profit

Business Information

1. Taxpayer Name (owner, partners or other business organization) (last, first, middle)

2. Trade Name/Doing Business As (if applicable)

3a. City in which your business is located

State

ZIP

3b. County in which your business is located

Telephone

(

)

4. Mailing Address (residence address, include unit number)

City

State

ZIP

County

FEIN

SSN

5. List specific products you provide (Explain in Detail).

Ownership

(1) Owner/Partner Name (last, first, middle) If Corporation, give Corporation name

SSN (FEIN # if applicable)

1a.

Address (residence or P.O. Box, street, city, state, ZIP)

Telephone

(

)

1b.

(2) Owner/Partner Name (last, first, middle) If Corporation, give Corporation name

SSN (FEIN # if applicable)

2a.

Address (residence or P.O. Box, street, city, state, ZIP)

Telephone

(

)

2b.

If there are other partners, list on separate sheet using the same format.

Sales

Period of Event

Mark The Box That

Fees

Applies To You

From

To

Make checks payable to:

Single Event License

Single event

Colorado Department of Revenue

$

0120-750

(999)

Denver, CO 80261-0013

Multiple Event License

Multiple event

$

0140-750

(999)

I declare under penalty or perjury in the second degree that the statements made in

Amount Owed

$

.00

this application are true and complete to the best of my knowledge.

Signature of Owner, Partner or Corporate Officer

Title

Date

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will

not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1