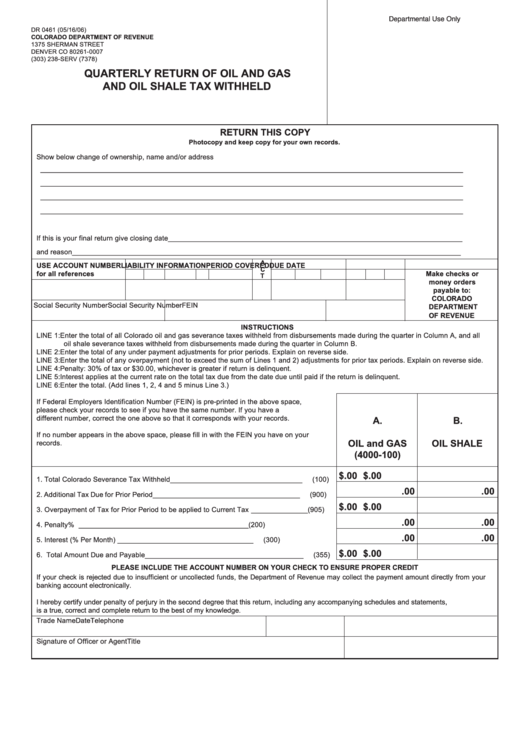

Form Dr 0461 - Quarterly Return Of Oil And Gas And Oil Shale Tax Withheld

ADVERTISEMENT

Departmental Use Only

DR 0461 (05/16/06)

COLORADO DEPARTMENT OF REVENUE

1375 SHERMAN STREET

DENVER CO 80261-0007

(303) 238-SERV (7378)

QUARTERLY RETURN OF OIL AND GAS

AND OIL SHALE TAX WITHHELD

RETURN THIS COPY

Photocopy and keep copy for your own records.

Show below change of ownership, name and/or address

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

If this is your final return give closing date ______________________________________________________________________________

and reason _______________________________________________________________________________________________________

A

USE ACCOUNT NUMBER

LIABILITY INFORMATION

PERIOD COVERED

DUE DATE

C

for all references

Make checks or

county

city

indust.

type

liability date

month

month

year

month

day

year

T

money orders

payable to:

COLORADO

Social Security Number

Social Security Number

FEIN

DEPARTMENT

OF REVENUE

INSTRUCTIONS

LINE 1: Enter the total of all Colorado oil and gas severance taxes withheld from disbursements made during the quarter in Column A, and all

oil shale severance taxes withheld from disbursements made during the quarter in Column B.

LINE 2: Enter the total of any under payment adjustments for prior periods. Explain on reverse side.

LINE 3: Enter the total of any overpayment (not to exceed the sum of Lines 1 and 2) adjustments for prior tax periods. Explain on reverse side.

LINE 4: Penalty: 30% of tax or $30.00, whichever is greater if return is delinquent.

LINE 5: Interest applies at the current rate on the total tax due from the date due until paid if the return is delinquent.

LINE 6: Enter the total. (Add lines 1, 2, 4 and 5 minus Line 3.)

If Federal Employers Identification Number (FEIN) is pre-printed in the above space,

please check your records to see if you have the same number. If you have a

different number, correct the one above so that it corresponds with your records.

B.

A.

If no number appears in the above space, please fill in with the FEIN you have on your

OIL and GAS

OIL SHALE

records.

(4000-100)

$

.00 $

.00

1. Total Colorado Severance Tax Withheld ___________________________________

(100)

.00

.00

2. Additional Tax Due for Prior Period _______________________________________

(900)

$

.00 $

.00

3. Overpayment of Tax for Prior Period to be applied to Current Tax _______________

(905)

.00

.00

4. Penalty

% _____________________________________________

(200)

.00

.00

5. Interest (

% Per Month) ____________________________________

(300)

$

.00 $

.00

6. Total Amount Due and Payable __________________________________________

(355)

PLEASE INCLUDE THE ACCOUNT NUMBER ON YOUR CHECK TO ENSURE PROPER CREDIT

If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your

banking account electronically.

I hereby certify under penalty of perjury in the second degree that this return, including any accompanying schedules and statements,

is a true, correct and complete return to the best of my knowledge.

Trade Name

Date

Telephone

Signature of Officer or Agent

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1