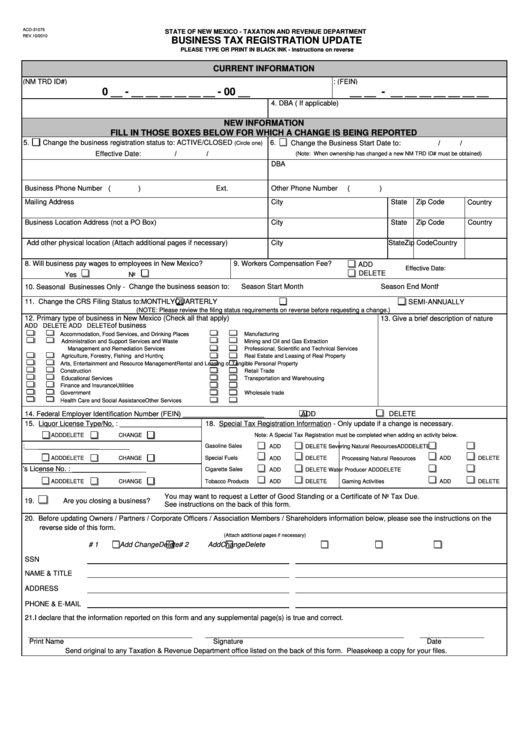

Business Tax Registration Update Form - New Mexico Taxation And Revenue Department

ADVERTISEMENT

ACD-31075

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

REV.10/2010

BUSINESS TAX REGISTRATION UPDATE

PLEASE TYPE OR PRINT IN BLACK INK - Instructions on reverse

CURRENT INFORMATION

1. New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#)

2. Federal Employer Identification Number: (FEIN)

0 __ - __ __ __ __ __ __ - 00 __

__ __ - __ __ __ __ __ __ __

3. Business Name

4. DBA ( If applicable)

NEW INFORMATION

FILL IN THOSE BOXES BELOW FOR WHICH A CHANGE IS BEING REPORTED

5.

Change the business registration status to: ACTIVE/CLOSED

6.

Change the Business Start Date to:

/

/

(Circle one)

Effective Date:

/

/

(Note: When ownership has changed a new NM TRD ID# must be obtained)

7. Business Name

DBA

Business Phone Number (

)

Ext.

Other Phone Number

(

)

Mailing Address

City

State

Zip Code

Country

Business Location Address (not a PO Box)

City

State

Zip Code

Country

Add other physical location (Attach additional pages if necessary)

City

State

Zip Code

Country

8. Will business pay wages to employees in New Mexico?

9. Workers Compensation Fee?

ADD

Yes

No

Effective Date:

DELETE

Yes

No

10. Seasonal Businesses Only - Change the business season to:

Season Start Month

Season End Month

11. Change the CRS Filing Status to:

MONTHLY

QUARTERLY

SEMI-ANNUALLY

(NOTE: Please review the filing status requirements on reverse before requesting a change.)

13. Give a brief description of nature

12. Primary type of business in New Mexico (Check all that apply)

of business

ADD DELETE

ADD DELETE

Accommodation, Food Services, and Drinking Places

Manufacturing

Administration and Support Services and Waste

Mining and Oil and Gas Extraction

Management and Remediation Services

Professional, Scientific and Technical Services

Agriculture, Forestry, Fishing and Hunting

Real Estate and Leasing of Real Property

Arts, Entertainment and Resource Management

Rental and Leasing of Tangible Personal Property

Retail Trade

Construction

Educational Services

Transportation and Warehousing

Finance and Insurance

Utilities

Government

Wholesale trade

Health Care and Social Assistance

Other Services

14. Federal Employer Identification Number (FEIN)

_____________________

ADD

DELETE

15. Liquor License Type/No. : ________________________

18. Special Tax Registration Information - Only update if a change is necessary.

Note: A Special Tax Registration must be completed when adding an activity below.

ADD

DELETE

CHANGE

16. Public Regulation Comm. No. :___________________

Gasoline Sales

ADD

DELETE

Severing Natural Resources

ADD

DELETE

Special Fuels

ADD

DELETE

CHANGE

ADD

DELETE

Processing Natural Resources

ADD

DELETE

17. RLD Contractor's License No. : ___________________

Cigarette Sales

ADD

DELETE

Water Producer

ADD

DELETE

Tobacco Products

ADD

DELETE

CHANGE

ADD

DELETE

Gaming Activities

ADD

DELETE

You may want to request a Letter of Good Standing or a Certificate of No Tax Due.

19.

Are you closing a business?

See instructions on the back of this form.

20. Before updating Owners / Partners / Corporate Officers / Association Members / Shareholders information below, please see the instructions on the

reverse side of this form.

(Attach additional pages if necessary)

# 1

Add

Change

Delete

# 2

Add

Change

Delete

SSN

NAME & TITLE

ADDRESS

PHONE & E-MAIL

21. I declare that the information reported on this form and any supplemental page(s) is true and correct.

Print Name

Signature

Date

Send original to any Taxation & Revenue Department office listed on the back of this form. Please keep a copy for your files.

17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1