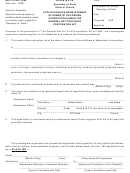

Form Vat 58 - Claim By Unregistered Farmer For Refund Of Value Added Tax (Vat) Under The Value-Added Tax (Refund Of Tax) (Flat-Rate Farmers) Order Page 4

ADVERTISEMENT

IMPORTANT NOTES

1. Bank details are required to be completed if the refund is to be issued to a bank account. A cheque will issue where

bank details are not provided.

2. Where the claim is for a refund of VAT on a Lease/Hire Agreement, a copy of the agreement, the invoice and

a Schedule of the VAT payable from the appropriate financial institution is required in respect of the first claim.

A Schedule of the VAT payable is required for all subsequent claims. A claim for a refund of VAT paid on a Hire

Purchase Agreement must be accompanied by a copy of the agreement and the invoice.

3. You must not be registered for VAT* either in respect of your farming business or in respect of any other trade,

profession or vocation carried on by you. If you are registered for VAT in respect of your farming business or in

respect of any other trade, profession or vocation you should claim the appropriate deduction on your VAT return

(Form VAT3).

* If you are registered for VAT only in respect of intra-community acquisitions a form VAT 58 may be completed.

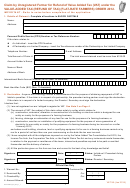

4. The enclosed invoices contain the following particulars:

(a) the date of issue of the invoice,

(b) a sequential number which uniquely identifies the invoice,

(c) the name, address and VAT registration number of the supplier,

(d) the customer’s name and address,

(e) a detailed description of the goods and services supplied,

(f)

the total cost, the rate of VAT and the VAT charged.

5. Repayment will not be made on delivery dockets, statements, quotations, advice notes, receipts (other than

customs receipts in the case of importations), or any other document which is not a VAT invoice. General

descriptions on invoices such as ‘miscellaneous hardware’ will not be accepted.

6. Claims for repayment of VAT must be made within 4 years from the end of the taxable period to which the claim

relates.

7. Wind Turbine system and Photo-Voltaic system must be named on Triple E Product Register. Triple E Product

Register means the public database maintained by the Sustainable Energy Authority of Ireland (SEAI) containing

a list of products which comply with the energy efficiency criteria of that Authority. It can be accessed at the SEAI

website:

8. A person who receives a refund of tax under VAT (REFUND OF TAX) (FLAT-RATE FARMERS) ORDER 2012 is

obliged, on or before the 28th day following the end of a period of one year from the date the tax was incurred, to

carry out a review to establish whether conditions of the Order have been met. If, during that period of one year,

the building, equipment etc. which was the subject of the refund has been disposed of, or has been used mainly

for purposes other than a farming business, the person who received the refund is liable to repay the amount of the

tax and any interest due to Revenue. If s/he fails to do so within a further 28 days of the 28th day following that one

year period s/he will be liable to a penalty of €4,000.

Invoices submitted will be returned.

Business records including invoices must be retained for a period of 6 years.

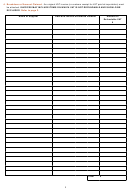

Applications to be forwarded to:

Office of the Revenue Commissioners,

LoCall:

1890 25 24 49

Collector-General’s Division,

Telephone:

061 488 060

Unregistered VAT Repayment Section,

Fax:

061 488 095

Ground Floor,

E-mail:

unregvat@revenue.ie

Sarsfield House,

Francis Street,

Limerick.

Further copies of this form may be obtained from the above address or downloaded from the Revenue website:

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4