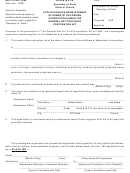

Form Vat 58 - Claim By Unregistered Farmer For Refund Of Value Added Tax (Vat) Under The Value-Added Tax (Refund Of Tax) (Flat-Rate Farmers) Order Page 3

ADVERTISEMENT

4. Breakdown of Amount Claimed

- An original VAT invoice (or customs receipt for VAT paid at importation) must

be attached. INVOICES MAY INCLUDE ITEMS ON WHICH VAT IS NOT REFUNDABLE AND SHOULD BE

EXCLUDED.

Refer to page 2.

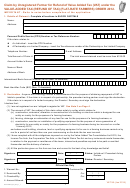

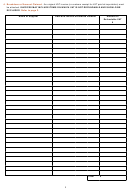

Name of Supplier

Date and Invoice Reference Number

Amount of

Refundable VAT

€

Total

€

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4