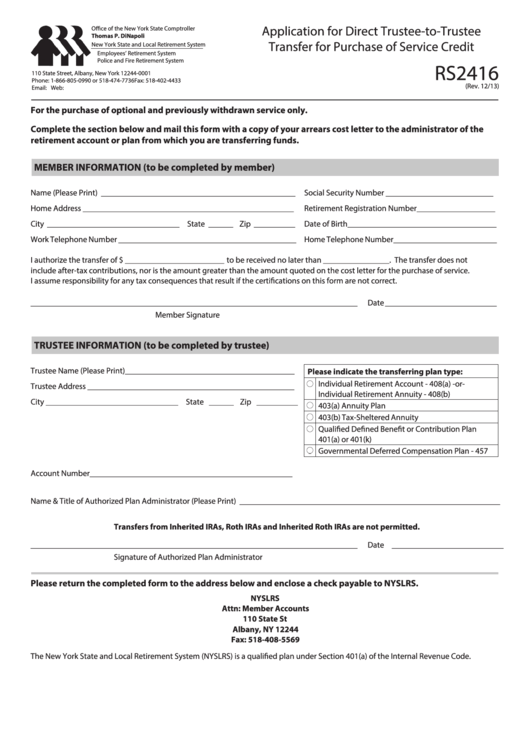

Application for Direct Trustee-to-Trustee

Office of the New York State Comptroller

Thomas P. DiNapoli

Transfer for Purchase of Service Credit

New York State and Local Retirement System

Employees’ Retirement System

Police and Fire Retirement System

RS2416

110 State Street, Albany, New York 12244-0001

Phone: 1-866-805-0990 or 518-474-7736

Fax: 518-402-4433

(Rev. 12/13)

Email: nyslrsinfo@osc.state.ny.us

Web:

For the purchase of optional and previously withdrawn service only.

Complete the section below and mail this form with a copy of your arrears cost letter to the administrator of the

retirement account or plan from which you are transferring funds.

MEMBER INFORMATION (to be completed by member)

Name (Please Print) _______________________________________________

Social Security Number __________________________

Home Address ___________________________________________________

Retirement Registration Number ___________________

City ________________________________ State ______ Zip __________

Date of Birth____________________________________

Work Telephone Number ___________________________________________

Home Telephone Number_________________________

I authorize the transfer of $ ________________________ to be received no later than ________________. The transfer does not

include after-tax contributions, nor is the amount greater than the amount quoted on the cost letter for the purchase of service.

I assume responsibility for any tax consequences that result if the certifications on this form are not correct.

_______________________________________________________________________________

Date ___________________________

Member Signature

TRUSTEE INFORMATION (to be completed by trustee)

Trustee Name (Please Print) _________________________________________

Please indicate the transferring plan type:

Individual Retirement Account - 408(a) -or-

Trustee Address __________________________________________________

Individual Retirement Annuity - 408(b)

City ________________________________ State ______ Zip __________

403(a) Annuity Plan

403(b) Tax-Sheltered Annuity

Qualified Defined Benefit or Contribution Plan

401(a) or 401(k)

Governmental Deferred Compensation Plan - 457

Account Number _________________________________________________

Name & Title of Authorized Plan Administrator (Please Print) _______________________________________________________________

Transfers from Inherited IRAs, Roth IRAs and Inherited Roth IRAs are not permitted.

_______________________________________________________________________________

Date ___________________________

Signature of Authorized Plan Administrator

Please return the completed form to the address below and enclose a check payable to NYSLRS.

NYSLRS

Attn: Member Accounts

110 State St

Albany, NY 12244

Fax: 518-408-5569

The New York State and Local Retirement System (NYSLRS) is a qualified plan under Section 401(a) of the Internal Revenue Code.

1

1