State Income Tax Withholding Form

Download a blank fillable State Income Tax Withholding Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete State Income Tax Withholding Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Caring For Those Who Serve

1901 Chestnut Avenue

Glenview, Illinois 60025-1604

1-800-851-2201

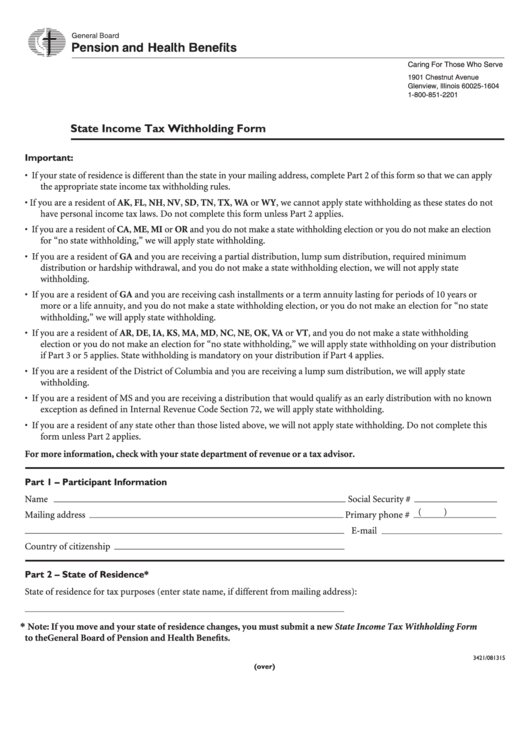

State Income Tax Withholding Form

Important:

•

If your state of residence is different than the state in your mailing address, complete Part 2 of this form so that we can apply

the appropriate state income tax withholding rules.

If you are a resident of AK, FL, NH, NV, SD, TN, TX, WA or WY, we cannot apply state withholding as these states do not

•

have personal income tax laws. Do not complete this form unless Part 2 applies.

•

If you are a resident of CA, ME, MI or OR and you do not make a state withholding election or you do not make an election

for “no state withholding,” we will apply state withholding.

If you are a resident of GA and you are receiving a partial distribution, lump sum distribution, required minimum

•

distribution or hardship withdrawal, and you do not make a state withholding election, we will not apply state

withholding.

•

If you are a resident of GA and you are receiving cash installments or a term annuity lasting for periods of 10 years or

more or a life annuity, and you do not make a state withholding election, or you do not make an election for “no state

withholding,” we will apply state withholding.

If you are a resident of AR, DE, IA, KS, MA, MD, NC, NE, OK, VA or VT, and you do not make a state withholding

•

election or you do not make an election for “no state withholding,” we will apply state withholding on your distribution

if Part 3 or 5 applies. State withholding is mandatory on your distribution if Part 4 applies.

•

If you are a resident of the District of Columbia and you are receiving a lump sum distribution, we will apply state

withholding.

•

If you are a resident of MS and you are receiving a distribution that would qualify as an early distribution with no known

exception as defined in Internal Revenue Code Section 72, we will apply state withholding.

•

If you are a resident of any state other than those listed above, we will not apply state withholding. Do not complete this

form unless Part 2 applies.

For more information, check with your state department of revenue or a tax advisor.

Part 1 – Participant Information

Name

Social Security #

_____________________________________________________________________________________

________________________

(

)

Mailing address

Primary phone #

__________________________________________________________________________

________________________

E-mail

_____________________________________________________________________________________________

___________________________________

Country of citizenship

___________________________________________________________________

Part 2 – State of Residence*

State of residence for tax purposes (enter state name, if different from mailing address):

_____________________________________________________________________________________________

* Note: If you move and your state of residence changes, you must submit a new State Income Tax Withholding Form

to the General Board of Pension and Health Benefits.

3421/081315

(over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2