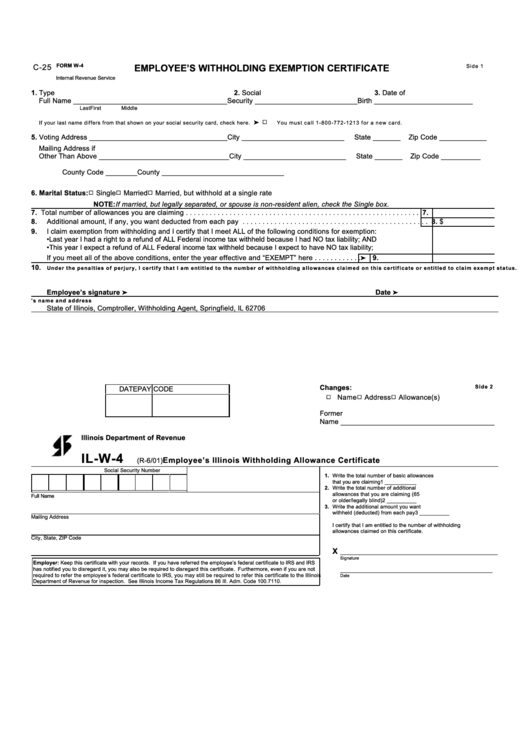

FORM W-4

C-25

EMPLOYEE’S WITHHOLDING EXEMPTION CERTIFICATE

S ide 1

U.S. Treasury Department

Internal Revenue Service

1. Type

2. Social

3. Date of

Full Name _______________________________________

Security __________________________

Birth _________________________

Last

First

Middle

If your last nam e differs from that shown on your social security card, check here.

You m ust call 1-800-772-1213 for a new card.

5. Voting Address ___________________________________

City __________________________

State _______

Zip Code ____________

Mailing Address if

Other Than Above _________________________________

City __________________________

State _______

Zip Code __________

County Code ________

County _______________________________

6. Marital Status:

Single

Married

Married, but withhold at a single rate

NOTE: If married, but legally separated, or spouse is non-resident alien, check the Single box.

7.

Total number of allowances you are claiming . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8.

Additional amount, if any, you want deducted from each pay . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. $

9.

I claim exemption from withholding and I certify that I meet ALL of the following conditions for exemption:

•

Last year I had a right to a refund of ALL Federal income tax withheld because I had NO tax liability; AND

•

This year I expect a refund of ALL Federal income tax withheld because I expect to have NO tax liability;

If you meet all of the above conditions, enter the year effective and “EXEMPT” here . . . . . . . . . . . .

9.

10.

U nder the penalties of perjury, I certify that I am entitled to the num ber of w ithholding allow ances claim ed on this certificate or entitled to claim exem pt status.

Employee’s signature

Date

11.

E m ployer’s nam e and address

State of Illinois, Comptroller, Withholding Agent, Springfield, IL 62706

S ide 2

Changes:

DATE

PAY CODE

Name

Address

Allowance(s)

Former

Name _______________________________________

Illinois Department of Revenue

IL-W-4

Employee’s Illinois W ithholding Allow ance Certificate

(R-6/01)

Social Security Number

1. Write the total number of basic allowances

that you are claiming

1 ___________

2. Write the total number of additional

allowances that you are claiming (65

Full Name

or older/legally blind)

2 __________

3. Write the additional amount you want

withheld (deducted) from each pay

3 __________

Mailing Address

I certify that I am entitled to the number of withholding

allowances claimed on this certificate.

City, State, ZIP Code

X

_____________________________________________________

Signature

Employer: Keep this certificate with your records. If you have referred the employee’s federal certificate to IRS and IRS

has notified you to disregard it, you may also be required to disregard this certificate. Furthermore, even if you are not

_____________________________________________________

required to refer the employee’s federal certificate to IRS, you may still be required to refer this certificate to the Illinois

Date

Department of Revenue for inspection. See Illinois Income Tax Regulations 86 Ill. Adm. Code 100.7110.

1

1