Form It-2104 - Employee'S Withholding Allowance Certificate 2011

ADVERTISEMENT

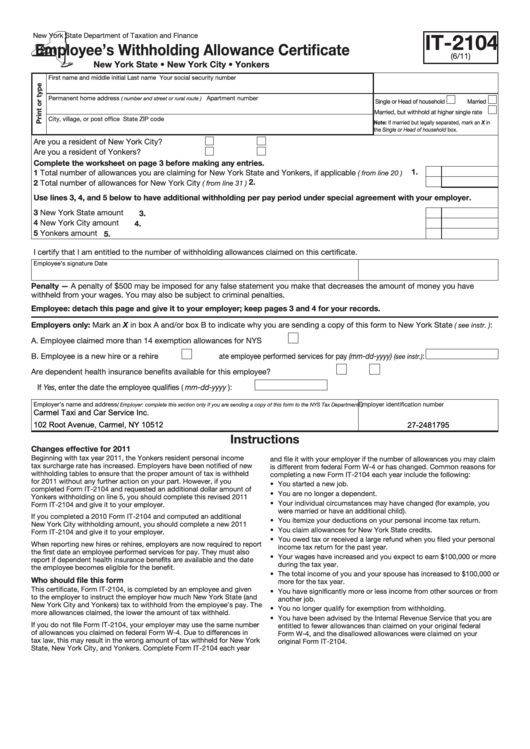

IT-2104

New York State Department of Taxation and Finance

Employee’s Withholding Allowance Certificate

(6/11)

New York State • New York City • Yonkers

First name and middle initial

Last name

Your social security number

Permanent home address

Apartment number

( number and street or rural route )

Single or Head of household

Married

Married, but withhold at higher single rate

City, village, or post office

State

ZIP code

Note: If married but legally separated, mark an X in

the Single or Head of household box.

Are you a resident of New York City? .......... Yes

No

Are you a resident of Yonkers? .................... Yes

No

Complete the worksheet on page 3 before making any entries.

1.

1 Total number of allowances you are claiming for New York State and Yonkers, if applicable

.........

( from line 20 )

2.

2 Total number of allowances for New York City

.................................................................................

( from line 31 )

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer.

3 New York State amount ........................................................................................................................................

3.

4 New York City amount ..........................................................................................................................................

4.

5 Yonkers amount ....................................................................................................................................................

5.

I certify that I am entitled to the number of withholding allowances claimed on this certificate.

Employee’s signature

Date

Penalty — A penalty of $500 may be imposed for any false statement you make that decreases the amount of money you have

withheld from your wages. You may also be subject to criminal penalties.

Employee: detach this page and give it to your employer; keep pages 3 and 4 for your records.

Employers only: Mark an X in box A and/or box B to indicate why you are sending a copy of this form to New York State

:

( see instr. )

A. Employee claimed more than 14 exemption allowances for NYS .... A.

B. Employee is a new hire or a rehire .... B.

First date employee performed services for pay (mm-dd-yyyy)

:

(see instr.)

Are dependent health insurance benefits available for this employee? ............ Yes

No

If Yes, enter the date the employee qualifies ( mm-dd-yyyy ):

Employer’s name and address

Employer identification number

( Employer: complete this section only if you are sending a copy of this form to the NYS Tax Department. )

Carmel Taxi and Car Service Inc.

102 Root Avenue, Carmel, NY 10512

27-2481795

Instructions

Changes effective for 2011

Beginning with tax year 2011, the Yonkers resident personal income

and file it with your employer if the number of allowances you may claim

tax surcharge rate has increased. Employers have been notified of new

is different from federal Form W-4 or has changed. Common reasons for

withholding tables to ensure that the proper amount of tax is withheld

completing a new Form IT-2104 each year include the following:

for 2011 without any further action on your part. However, if you

• You started a new job.

completed Form IT-2104 and requested an additional dollar amount of

• You are no longer a dependent.

Yonkers withholding on line 5, you should complete this revised 2011

• Your individual circumstances may have changed (for example, you

Form IT-2104 and give it to your employer.

were married or have an additional child).

If you completed a 2010 Form IT-2104 and computed an additional

• You itemize your deductions on your personal income tax return.

New York City withholding amount, you should complete a new 2011

• You claim allowances for New York State credits.

Form IT-2104 and give it to your employer.

• You owed tax or received a large refund when you filed your personal

When reporting new hires or rehires, employers are now required to report

income tax return for the past year.

the first date an employee performed services for pay. They must also

• Your wages have increased and you expect to earn $100,000 or more

report if dependent health insurance benefits are available and the date

during the tax year.

the employee becomes eligible for the benefit.

• The total income of you and your spouse has increased to $100,000 or

Who should file this form

more for the tax year.

This certificate, Form IT-2104, is completed by an employee and given

• You have significantly more or less income from other sources or from

to the employer to instruct the employer how much New York State (and

another job.

New York City and Yonkers) tax to withhold from the employee’s pay. The

• You no longer qualify for exemption from withholding.

more allowances claimed, the lower the amount of tax withheld.

• You have been advised by the Internal Revenue Service that you are

If you do not file Form IT-2104, your employer may use the same number

entitled to fewer allowances than claimed on your original federal

of allowances you claimed on federal Form W-4. Due to differences in

Form W-4, and the disallowed allowances were claimed on your

tax law, this may result in the wrong amount of tax withheld for New York

original Form IT-2104.

State, New York City, and Yonkers. Complete Form IT-2104 each year

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4