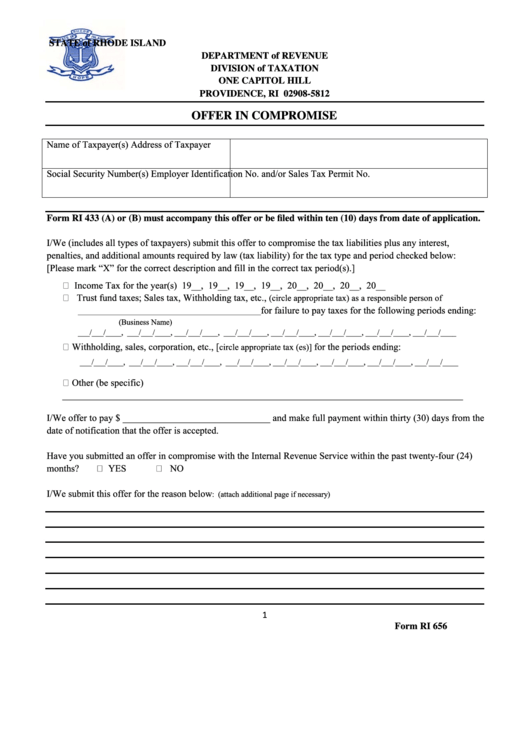

Form Ri 656 - Offer In Compromise - Department Of Revenue, State Of Rhode Island

ADVERTISEMENT

STATE of RHODE ISLAND

DEPARTMENT of REVENUE

DIVISION of TAXATION

ONE CAPITOL HILL

PROVIDENCE, RI 02908-5812

OFFER IN COMPROMISE

Name of Taxpayer(s)

Address of Taxpayer

Social Security Number(s)

Employer Identification No. and/or Sales Tax Permit No.

Form RI 433 (A) or (B) must accompany this offer or be filed within ten (10) days from date of application.

I/We (includes all types of taxpayers) submit this offer to compromise the tax liabilities plus any interest,

penalties, and additional amounts required by law (tax liability) for the tax type and period checked below:

[Please mark “X” for the correct description and fill in the correct tax period(s).]

Income Tax for the year(s) 19__, 19__, 19__, 19__, 20__, 20__, 20__, 20__

Trust fund taxes; Sales tax, Withholding tax, etc.,

(circle appropriate tax) as a responsible person of

for failure to pay taxes for the following periods ending:

_______________________________________________

(Business Name)

___/___/____, ___/___/____, ___/___/____, ___/___/____, ___/___/____, ___/___/____, ___/___/____, ___/___/____

Withholding, sales, corporation, etc., [

for the periods ending:

circle appropriate tax (es)]

___/___/____, ___/___/____, ___/___/____, ___/___/____, ___/___/____, ___/___/____, ___/___/____, ___/___/____

Other (be specific)

____________________________________________________________________________________

I/We offer to pay $ _______________________________ and make full payment within thirty (30) days from the

date of notification that the offer is accepted.

Have you submitted an offer in compromise with the Internal Revenue Service within the past twenty-four (24)

months?

YES

NO

I/We submit this offer for the reason below

: (attach additional page if necessary)

1

Form RI 656

Revised 12/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2