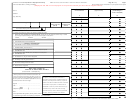

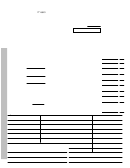

Deposit And Service Report Form Page 2

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING AND RETURNING THE

DEPOSIT AND SERVICE REPORT

EARNINGS

1. Earnings under 2014–2015 contract should be the amount earned by the employee during the 2014–2015 fiscal

year under the most recent contract. Do not include pickup included in compensation or supplemental earnings.

2. Balance of 2013–2014 contract would be any amount reported as earnings in the 2014–2015 fiscal year that was

under the 2013–2014 contract, e.g., July earnings for an individual employed on a 260-day August through July

contract.

3. Amount reported in the STRS Ohio 2014–2015 fiscal year is compensation reported in 2014–2015 that was

actually earned before July 1, 2014, in the 2013–2014 fiscal year.

4. Supplemental or additional earnings are earnings for additional service outside the employee’s base contract.

Please list and describe each supplemental and indicate the amount earned. Examples include extended days,

coaching, summer earnings, etc.

5. Pickup amounts should be supplied only if pickup is included in compensation for retirement purposes.

6. Total 2014–2015 employee earnings (sum of 1 through 5).

CONTRIBUTIONS

7. Employee contributions — regular are employee contributions that are INCLUDED in the employee’s gross

earnings for federal and state income taxes.

8. Employee contributions — picked up are employee contributions that are EXCLUDED from the employee’s

gross earnings for federal and state income taxes.

9. Total 2014–2015 employee contributions are the sum of lines 7 and 8. (Should equal line 6 times 12%.)

SERVICE CREDIT AND CONTRACT INFORMATION

10. Service credit earned in the 2014–2015 fiscal year. (See the STRS Ohio Employers Manual for a full description

of service credit.)

11. Last payroll date is the last pay date that payment was or will be issued to the employee.

12. Last day employee worked (including used sick days or used vacation).

13. Position held by employee during 2014–2015 (classroom teacher, principal, professor, etc.).

14. Contract salary is the amount the employee would have earned, excluding supplemental contracts or payments for

additional services, had the employee completed the current contract, including any midyear increases.

15. Beginning and ending dates of full contract should indicate the month and day service was contracted to begin

and end. Also indicate the number of days of service in the full contract (even if not completed).

16. Percentage increase generally granted to teaching employees is the overall increase in salary schedules, or other

salary documentation, for the current contract year over the preceding contract year covering teaching employees

who are STRS Ohio members. For employers without salary schedules, indicate average increase paid to teaching

employees.

INFORMATION ON RETURNING FORM

At the earliest possible date, return the report portion of this form in the postage-paid return envelope. This form

needs to be certified by a treasurer or payroll officer. The information contained in this report will be updated in our

records and should be included on the applicable year’s Annual Report.

50-103b, 4/14/1

v. 14–15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2