Deposit And Service Report Form

ADVERTISEMENT

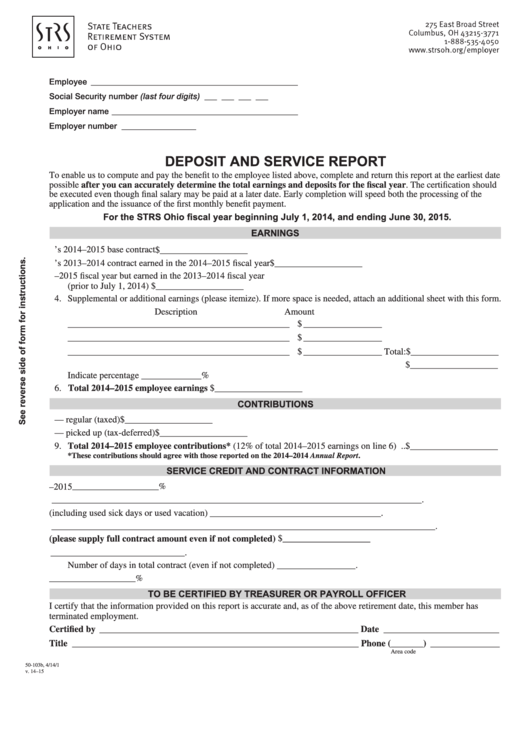

Employee __________________________________________________

Social Security number (last four digits) ___ ___ ___ ___

Employer name _____________________________________________

Employer number __________________

DEPOSIT AND SERVICE REPORT

To enable us to compute and pay the benefit to the employee listed above, complete and return this report at the earliest date

possible after you can accurately determine the total earnings and deposits for the fiscal year. The certification should

be executed even though final salary may be paid at a later date. Early completion will speed both the processing of the

application and the issuance of the first monthly benefit payment.

For the STRS Ohio fiscal year beginning July 1, 2014, and ending June 30, 2015.

EARNINGS

1. Earnings under employee’s 2014–2015 base contract ............................................................. $___________________

2. Balance of employee’s 2013–2014 contract earned in the 2014–2015 fiscal year .................. $___________________

3. Amount reported in the 2014–2015 fiscal year but earned in the 2013–2014 fiscal year

(prior to July 1, 2014) .............................................................................................................. $___________________

4. Supplemental or additional earnings (please itemize). If more space is needed, attach an additional sheet with this form.

Description

Amount

________________________________________________ $ _________________

Total:

________________________________________________ $ _________________

Total:

________________________________________________ $ _________________ Total: $___________________

5. Pickup included in compensation for retirement purposes ......................................................

$___________________

Indicate percentage _____________%

6. Total 2014–2015 employee earnings ..................................................................................... $___________________

CONTRIBUTIONS

7. Employee contributions — regular (taxed) .............................................................................. $___________________

8. Employee contributions — picked up (tax-deferred) .............................................................. $___________________

9. Total 2014–2015 employee contributions* (12% of total 2014–2015 earnings on line 6) ...

$___________________

*These contributions should agree with those reported on the 2014–2014 Annual Report.

SERVICE CREDIT AND CONTRACT INFORMATION

10. Service credit earned in 2014–2015 ......................................................................................... ____________________%

11. Last payroll date ________________________________________________________________________________.

12. Last day employee worked (including used sick days or used vacation) _____________________________________.

13. Position held ___________________________________________________________________________________.

14. Contract salary (please supply full contract amount even if not completed) ..................... $___________________

15. Beginning and ending dates of full contract ____________________________to _____________________________.

Number of days in total contract (even if not completed) _________________.

16. Percentage increase generally granted to teaching employees ................................................ ____________________%

TO BE CERTIFIED BY TREASURER OR PAYROLL OFFICER

I certify that the information provided on this report is accurate and, as of the above retirement date, this member has

terminated employment.

Certified by ________________________________________________________ Date _________________________

Title ______________________________________________________________ Phone (_______) _______________

Area code

50-103b, 4/14/1

v. 14–15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2