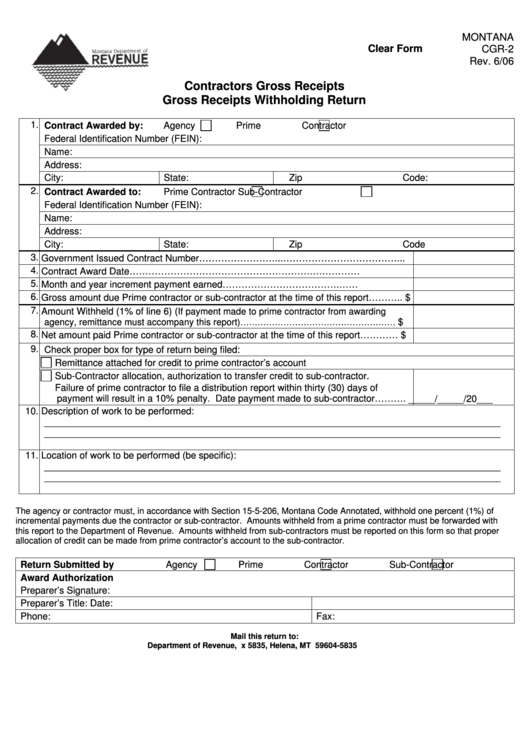

MONTANA

Clear Form

CGR-2

Rev. 6/06

Contractors Gross Receipts

Gross Receipts Withholding Return

1.

Contract Awarded by:

Agency

Prime Contractor

Federal Identification Number (FEIN):

Name:

Address:

City:

State:

Zip Code:

2.

Contract Awarded to:

Prime Contractor

Sub-Contractor

Federal Identification Number (FEIN):

Name:

Address:

City:

State:

Zip Code

3. Government Issued Contract Number……………………...………………………………...

4. Contract Award Date………………………………………………….……………................. _____/_____/20___

5. Month and year increment payment earned……………………………….…….................

_____/20___

6. Gross amount due Prime contractor or sub-contractor at the time of this report………..

$

7. Amount Withheld (1% of line 6) ( If payment made to prime contractor from awarding

$

agency, remittance must accompany this report )………………………………………………......

8. Net amount paid Prime contractor or sub-contractor at the time of this report…………

$

9.

Check proper box for type of return being filed:

Remittance attached for credit to prime contractor’s account

Sub-Contractor allocation, authorization to transfer credit to sub-contractor.

Failure of prime contractor to file a distribution report within thirty (30) days of

payment will result in a 10% penalty. Date payment made to sub-contractor……….

_____/_____/20___

10. Description of work to be performed:

_______________________________________________________________________________________

_______________________________________________________________________________________

11. Location of work to be performed (be specific):

_______________________________________________________________________________________

_______________________________________________________________________________________

The agency or contractor must, in accordance with Section 15-5-206, Montana Code Annotated, withhold one percent (1%) of

incremental payments due the contractor or sub-contractor. Amounts withheld from a prime contractor must be forwarded with

this report to the Department of Revenue. Amounts withheld from sub-contractors must be reported on this form so that proper

allocation of credit can be made from prime contractor’s account to the sub-contractor.

Return Submitted by

Agency

Prime Contractor

Sub-Contractor

Award Authorization

Preparer’s Signature:

Preparer’s Title:

Date:

Phone:

Fax:

Mail this return to:

Department of Revenue, P.O. Box 5835, Helena, MT 59604-5835

1

1