Print

Clear

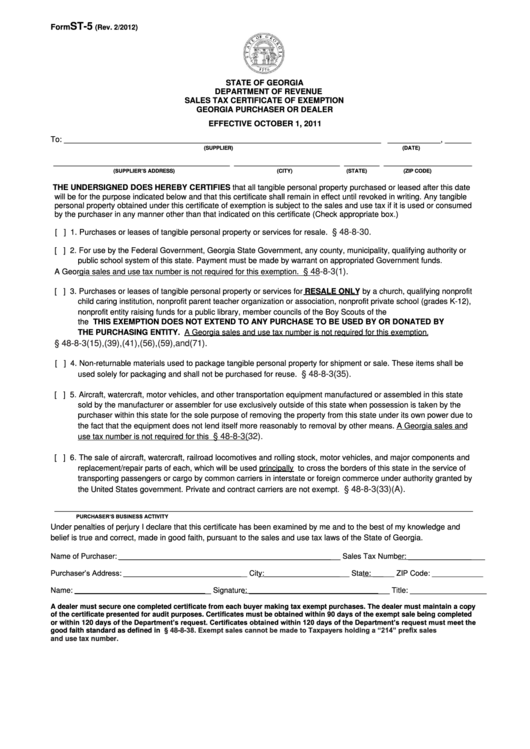

ST-5

Form

(Rev. 2/2012)

STATE OF GEORGIA

DEPARTMENT OF REVENUE

SALES TAX CERTIFICATE OF EXEMPTION

GEORGIA PURCHASER OR DEALER

EFFECTIVE OCTOBER 1, 2011

To: ________________________________________________________________________ ____________, ______

(SUPPLIER)

(DATE)

________________________________________ ________________________ ________ ____________________

(SUPPLIER’S ADDRESS)

(CITY)

(STATE)

(ZIP CODE)

THE UNDERSIGNED DOES HEREBY CERTIFIES that all tangible personal property purchased or leased after this date

will be for the purpose indicated below and that this certificate shall remain in effect until revoked in writing. Any tangible

personal property obtained under this certificate of exemption is subject to the sales and use tax if it is used or consumed

by the purchaser in any manner other than that indicated on this certificate (Check appropriate box.)

§ 48-8-30.

[ ] 1. Purchases or leases of tangible personal property or services for resale. O.C.G.A.

[ ] 2. For use by the Federal Government, Georgia State Government, any county, municipality, qualifying authority or

public school system of this state. Payment must be made by warrant on appropriated Government funds.

§ 48-8-3(1).

A Georgia sales and use tax number is not required for this exemption. O.C.G.A.

[ ] 3. Purchases or leases of tangible personal property or services for RESALE ONLY by a church, qualifying nonprofit

child caring institution, nonprofit parent teacher organization or association, nonprofit private school (grades K-12),

nonprofit entity raising funds for a public library, member councils of the Boy Scouts of the U.S.A. or Girl Scouts of

the U.S.A. THIS EXEMPTION DOES NOT EXTEND TO ANY PURCHASE TO BE USED BY OR DONATED BY

THE PURCHASING ENTITY. A Georgia sales and use tax number is not required for this exemption.

§ 48-8-3(15),(39),(41),(56),(59),and(71).

O.C.G.A.

[ ] 4. Non-returnable materials used to package tangible personal property for shipment or sale. These items shall be

§ 48-8-3(35).

used solely for packaging and shall not be purchased for reuse. O.C.G.A.

[ ] 5. Aircraft, watercraft, motor vehicles, and other transportation equipment manufactured or assembled in this state

sold by the manufacturer or assembler for use exclusively outside of this state when possession is taken by the

purchaser within this state for the sole purpose of removing the property from this state under its own power due to

the fact that the equipment does not lend itself more reasonably to removal by other means. A Georgia sales and

§ 48-8-3(32).

use tax number is not required for this exemption. O.C.G.A.

[ ] 6. The sale of aircraft, watercraft, railroad locomotives and rolling stock, motor vehicles, and major components and

replacement/repair parts of each, which will be used principally to cross the borders of this state in the service of

transporting passengers or cargo by common carriers in interstate or foreign commerce under authority granted by

§ 48-8-3(33)(A).

the United States government. Private and contract carriers are not exempt. O.C.G.A.

_______________________________________________________________________________________________

PURCHASER’S BUSINESS ACTIVITY

Under penalties of perjury I declare that this certificate has been examined by me and to the best of my knowledge and

belief is true and correct, made in good faith, pursuant to the sales and use tax laws of the State of Georgia.

Name of Purchaser: ____________________________________________________ Sales Tax Number: __________________

Purchaser’s Address: _____________________________ City:____________________ State: _____ ZIP Code: ____________

Name: ________________________________ Signature: _________________________________ Title: __________________

A dealer must secure one completed certificate from each buyer making tax exempt purchases. The dealer must maintain a copy

of the certificate presented for audit purposes. Certificates must be obtained within 90 days of the exempt sale being completed

or within 120 days of the Department’s request. Certificates obtained within 120 days of the Department’s request must meet the

§ 48-8-38. Exempt sales cannot be made to Taxpayers holding a “214” prefix sales

good faith standard as defined in O.C.G.A.

and use tax number.

1

1