Print

Reset

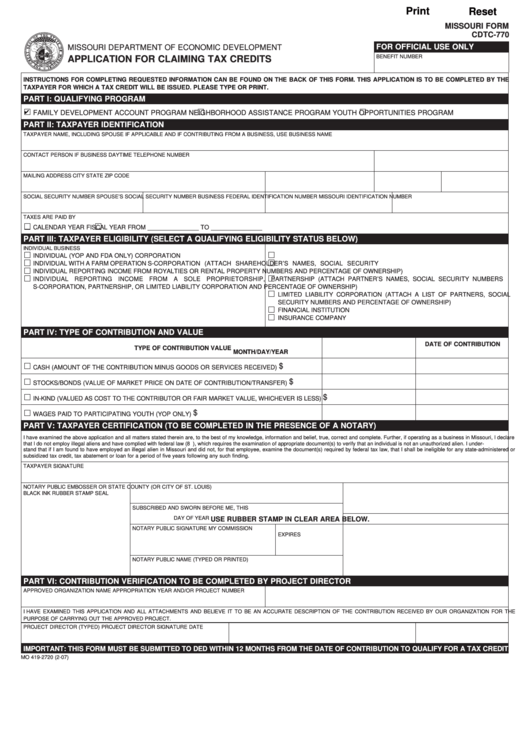

MISSOURI FORM

CDTC-770

FOR OFFICIAL USE ONLY

MISSOURI DEPARTMENT OF ECONOMIC DEVELOPMENT

BENEFIT NUMBER

APPLICATION FOR CLAIMING TAX CREDITS

INSTRUCTIONS FOR COMPLETING REQUESTED INFORMATION CAN BE FOUND ON THE BACK OF THIS FORM. THIS APPLICATION IS TO BE COMPLETED BY THE

TAXPAYER FOR WHICH A TAX CREDIT WILL BE ISSUED. PLEASE TYPE OR PRINT.

PART I: QUALIFYING PROGRAM

FAMILY DEVELOPMENT ACCOUNT PROGRAM

NEIGHBORHOOD ASSISTANCE PROGRAM

YOUTH OPPORTUNITIES PROGRAM

PART II: TAXPAYER IDENTIFICATION

TAXPAYER NAME, INCLUDING SPOUSE IF APPLICABLE AND IF CONTRIBUTING FROM A BUSINESS, USE BUSINESS NAME

CONTACT PERSON IF BUSINESS

DAYTIME TELEPHONE NUMBER

MAILING ADDRESS

CITY

STATE

ZIP CODE

SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

BUSINESS FEDERAL IDENTIFICATION NUMBER

MISSOURI IDENTIFICATION NUMBER

TAXES ARE PAID BY

CALENDAR YEAR

FISCAL YEAR FROM _______________ TO _______________

PART III: TAXPAYER ELIGIBILITY (SELECT A QUALIFYING ELIGIBILITY STATUS BELOW)

INDIVIDUAL

BUSINESS

INDIVIDUAL (YOP AND FDA ONLY)

CORPORATION

INDIVIDUAL WITH A FARM OPERATION

S-CORPORATION (ATTACH SHAREHOLDER’S NAMES, SOCIAL SECURITY

INDIVIDUAL REPORTING INCOME FROM ROYALTIES OR RENTAL PROPERTY

NUMBERS AND PERCENTAGE OF OWNERSHIP)

INDIVIDUAL REPORTING INCOME FROM A SOLE PROPRIETORSHIP,

PARTNERSHIP (ATTACH PARTNER’S NAMES, SOCIAL SECURITY NUMBERS

S-CORPORATION, PARTNERSHIP, OR LIMITED LIABILITY CORPORATION

AND PERCENTAGE OF OWNERSHIP)

LIMITED LIABILITY CORPORATION (ATTACH A LIST OF PARTNERS, SOCIAL

SECURITY NUMBERS AND PERCENTAGE OF OWNERSHIP)

FINANCIAL INSTITUTION

INSURANCE COMPANY

PART IV: TYPE OF CONTRIBUTION AND VALUE

DATE OF CONTRIBUTION

TYPE OF CONTRIBUTION

VALUE

MONTH/DAY/YEAR

$

CASH (AMOUNT OF THE CONTRIBUTION MINUS GOODS OR SERVICES RECEIVED)

$

STOCKS/BONDS (VALUE OF MARKET PRICE ON DATE OF CONTRIBUTION/TRANSFER)

$

IN-KIND (VALUED AS COST TO THE CONTRIBUTOR OR FAIR MARKET VALUE, WHICHEVER IS LESS)

$

WAGES PAID TO PARTICIPATING YOUTH (YOP ONLY)

PART V: TAXPAYER CERTIFICATION (TO BE COMPLETED IN THE PRESENCE OF A NOTARY)

I have examined the above application and all matters stated therein are, to the best of my knowledge, information and belief, true, correct and complete. Further, if operating as a business in Missouri, I declare

that I do not employ illegal aliens and have complied with federal law (8 U.S.C. 1324A), which requires the examination of appropriate document(s) to verify that an individual is not an unauthorized alien. I under

stand that if I am found to have employed an illegal alien in Missouri and did not, for that employee, examine the document(s) required by federal tax law, that I shall be ineligible for any state-administered or

subsidized tax credit, tax abatement or loan for a period of five years following any such finding.

TAXPAYER SIGNATURE

NOTARY PUBLIC EMBOSSER OR

STATE

COUNTY (OR CITY OF ST. LOUIS)

BLACK INK RUBBER STAMP SEAL

SUBSCRIBED AND SWORN BEFORE ME, THIS

DAY OF

YEAR

USE RUBBER STAMP IN CLEAR AREA BELOW.

NOTARY PUBLIC SIGNATURE

MY COMMISSION

EXPIRES

NOTARY PUBLIC NAME (TYPED OR PRINTED)

PART VI: CONTRIBUTION VERIFICATION TO BE COMPLETED BY PROJECT DIRECTOR

APPROVED ORGANIZATION NAME

APPROPRIATION YEAR AND/OR PROJECT NUMBER

I HAVE EXAMINED THIS APPLICATION AND ALL ATTACHMENTS AND BELIEVE IT TO BE AN ACCURATE DESCRIPTION OF THE CONTRIBUTION RECEIVED BY OUR ORGANIZATION FOR THE

PURPOSE OF CARRYING OUT THE APPROVED PROJECT.

PROJECT DIRECTOR (TYPED)

PROJECT DIRECTOR SIGNATURE

DATE

IMPORTANT: THIS FORM MUST BE SUBMITTED TO DED WITHIN 12 MONTHS FROM THE DATE OF CONTRIBUTION TO QUALIFY FOR A TAX CREDIT.

MO 419-2720 (2-07)

1

1