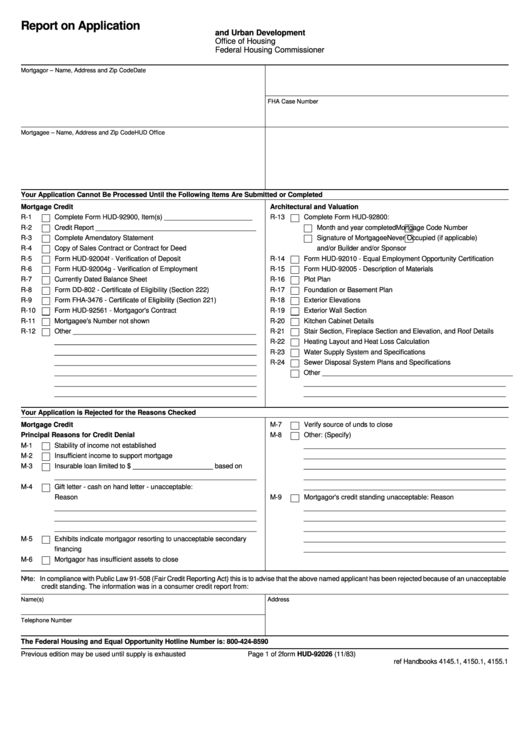

Report on Application

U.S. Department of Housing

and Urban Development

Office of Housing

Federal Housing Commissioner

Mortgagor – Name, Address and Zip Code

Date

FHA Case Number

Mortgagee – Name, Address and Zip Code

HUD Office

Your Application Cannot Be Processed Until the Following Items Are Submitted or Completed

Mortgage Credit

Architectural and Valuation

R-1

Complete Form HUD-92900, Item(s) _______________________

R-13

Complete Form HUD-92800:

R-2

Credit Report __________________________________________

Month and year completed

Mortgage Code Number

R-3

Complete Amendatory Statement

Signature of Mortgagee

Never Occupied (if applicable)

R-4

Copy of Sales Contract or Contract for Deed

and/or Builder and/or Sponsor

R-5

Form HUD-92004f - Verification of Deposit

R-14

Form HUD-92010 - Equal Employment Opportunity Certification

R-6

Form HUD-92004g - Verification of Employment

R-15

Form HUD-92005 - Description of Materials

R-7

Currently Dated Balance Sheet

R-16

Plot Plan

R-8

Form DD-802 - Certificate of Eligibility (Section 222)

R-17

Foundation or Basement Plan

R-9

Form FHA-3476 - Certificate of Eligibility (Section 221)

R-18

Exterior Elevations

R-10

Form HUD-92561 - Mortgagor's Contract

R-19

Exterior Wall Section

R-11

Mortgagee's Number not shown

R-20

Kitchen Cabinet Details

R-12

Other ________________________________________________

R-21

Stair Section, Fireplace Section and Elevation, and Roof Details

_____________________________________________________

R-22

Heating Layout and Heat Loss Calculation

_____________________________________________________

R-23

Water Supply System and Specifications

_____________________________________________________

R-24

Sewer Disposal System Plans and Specifications

_____________________________________________________

Other __________________________________________________

_____________________________________________________

_____________________________________________________

_____________________________________________________

_____________________________________________________

Your Application is Rejected for the Reasons Checked

Mortgage Credit

M-7

Verify source of unds to close

Principal Reasons for Credit Denial

M-8

Other: (Specify)

M-1

Stability of income not established

_____________________________________________________

M-2

Insufficient income to support mortgage

_____________________________________________________

M-3

Insurable loan limited to $ _____________________ based on

_____________________________________________________

_____________________________________________________

_____________________________________________________

M-4

Gift letter - cash on hand letter - unacceptable:

_____________________________________________________

Reason

M-9

Mortgagor's credit standing unacceptable: Reason

_____________________________________________________

_____________________________________________________

_____________________________________________________

_____________________________________________________

_____________________________________________________

_____________________________________________________

M-5

Exhibits indicate mortgagor resorting to unacceptable secondary

_____________________________________________________

financing

_____________________________________________________

M-6

Mortgagor has insufficient assets to close

Note: In compliance with Public Law 91-508 (Fair Credit Reporting Act) this is to advise that the above named applicant has been rejected because of an unacceptable

credit standing. The information was in a consumer credit report from:

Name(s)

Address

Telephone Number

The Federal Housing and Equal Opportunity Hotline Number is: 800-424-8590

Previous edition may be used until supply is exhausted

Page 1 of 2

form HUD-92026 (11/83)

ref Handbooks 4145.1, 4150.1, 4155.1

1

1 2

2