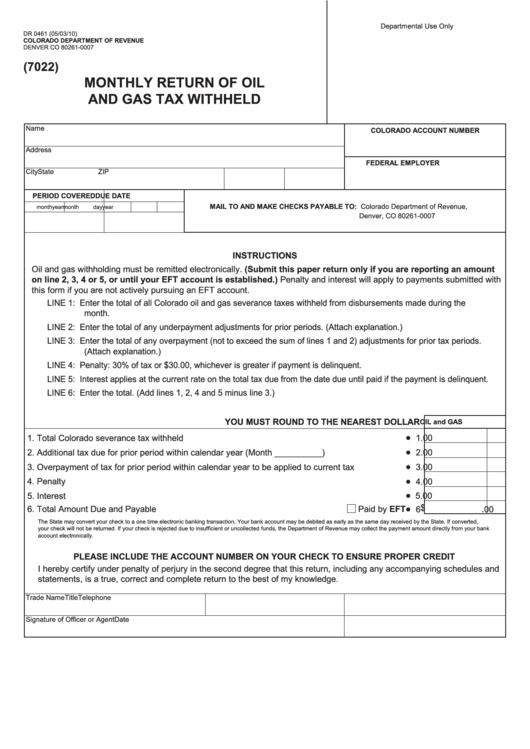

Form Dr 0461 - Monthly Return Of Oil And Gas Tax Withheld - Department Of Revenue, State Of Colorado

ADVERTISEMENT

Departmental Use Only

DR 0461 (05/03/10)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0007

(7022)

MONTHLY RETURN OF OIL

AND GAS TAX WITHHELD

Name

COLORADO ACCOUNT NUMBER

Address

FEDERAL EMPLOYER I.D. NUMBER

City

State

ZIP

PERIOD COVERED

DUE DATE

MAIL TO AND MAkE CHECkS PAYABLE TO: Colorado Department of Revenue,

month

year

month

day

year

Denver, CO 80261-0007

INSTRUCTIONS

Oil and gas withholding must be remitted electronically. (Submit this paper return only if you are reporting an amount

on line 2, 3, 4 or 5, or until your EFT account is established.) Penalty and interest will apply to payments submitted with

this form if you are not actively pursuing an EFT account.

LINE 1: Enter the total of all Colorado oil and gas severance taxes withheld from disbursements made during the

month.

LINE 2: Enter the total of any underpayment adjustments for prior periods. (Attach explanation.)

LINE 3: Enter the total of any overpayment (not to exceed the sum of lines 1 and 2) adjustments for prior tax periods.

(Attach explanation.)

LINE 4: Penalty: 30% of tax or $30.00, whichever is greater if payment is delinquent.

LINE 5: Interest applies at the current rate on the total tax due from the date due until paid if the payment is delinquent.

LINE 6: Enter the total. (Add lines 1, 2, 4 and 5 minus line 3.)

YOU MUST ROUND TO THE NEAREST DOLLAR

OIL and GAS

•

1. Total Colorado severance tax withheld ...........................................................................................

1

.00

•

2. Additional tax due for prior period within calendar year (Month __________) ................................

2

.00

•

3. Overpayment of tax for prior period within calendar year to be applied to current tax ...................

3

.00

•

4. Penalty ............................................................................................................................................

4

.00

•

5. Interest ............................................................................................................................................

5

.00

•

6 $

6. Total Amount Due and Payable ...............................................................................

Paid by EFT

.00

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted,

your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank

account electronically.

PLEASE INCLUDE THE ACCOUNT NUMBER ON YOUR CHECk TO ENSURE PROPER CREDIT

I hereby certify under penalty of perjury in the second degree that this return, including any accompanying schedules and

statements, is a true, correct and complete return to the best of my knowledge.

Trade Name

Title

Telephone

Signature of Officer or Agent

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1