Form Wv/cig-7.09 Monthly Report For Distributors And / Or Wholesalers Of Cigarettes

ADVERTISEMENT

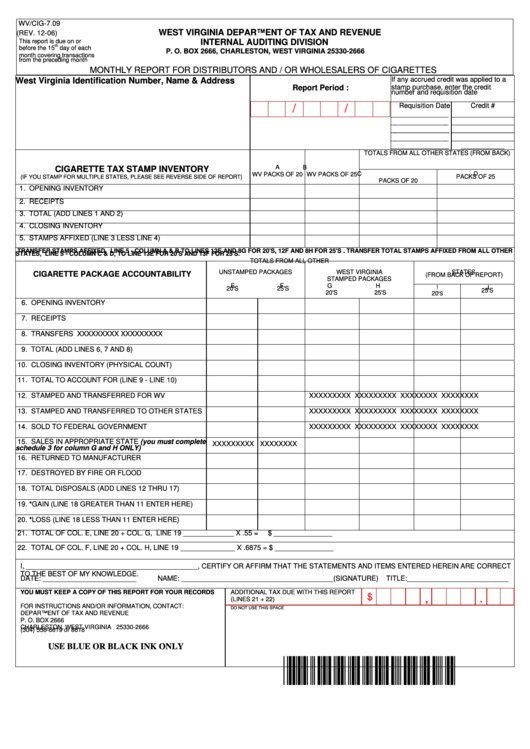

WV/CIG-7.09

WEST VIRGINIA DEPARTMENT OF TAX AND REVENUE

(REV. 12-06)

This report is due on or

INTERNAL AUDITING DIVISION

th

before the 15

day of each

P. O. BOX 2666, CHARLESTON, WEST VIRGINIA 25330-2666

month covering transactions

from the preceding month

MONTHLY REPORT FOR DISTRIBUTORS AND / OR WHOLESALERS OF CIGARETTES

If any accrued credit was applied to a

West Virginia Identification Number, Name & Address

Report Period :

stamp purchase, enter the credit

number and requisition date

Requisition Date

Credit #

/

/

_______________

________________

_______________

________________

_______________

________________

_______________

________________

_______________

___________

TOTALS FROM ALL OTHER STATES (FROM BACK)

A

B

CIGARETTE TAX STAMP INVENTORY

C

D

WV PACKS OF 20

WV PACKS OF 25

(IF YOU STAMP FOR MULTIPLE STATES, PLEASE SEE REVERSE SIDE OF REPORT)

PACKS OF 20

PACKS OF 25

1. OPENING INVENTORY

2. RECEIPTS

3. TOTAL (ADD LINES 1 AND 2)

4. CLOSING INVENTORY

5. STAMPS AFFIXED (LINE 3 LESS LINE 4)

TRANSFER STAMPS AFFIXED, LINE 5 - COLUMN A & B TO LINES 12E AND 8G FOR 20'S, 12F AND 8H FOR 25'S . TRANSFER TOTAL STAMPS AFFIXED FROM ALL OTHER

STATES, LINE 5 - COLUMN C & D, TO LINE 13E FOR 20'S AND 13F FOR 25'S.

TOTALS FROM ALL OTHER

UNSTAMPED PACKAGES

WEST VIRGINIA

STATES

CIGARETTE PACKAGE ACCOUNTABILITY

STAMPED PACKAGES

(FROM BACK OF REPORT)

E

F

G

H

I

J

20'S

25'S

20'S

25'S

20

'S

25'S

6. OPENING INVENTORY

7. RECEIPTS

8. TRANSFERS

XXXXXXXXX

XXXXXXXXX

9. TOTAL (ADD LINES 6, 7 AND 8)

10. CLOSING INVENTORY (PHYSICAL COUNT)

11. TOTAL TO ACCOUNT FOR (LINE 9 - LINE 10)

12. STAMPED AND TRANSFERRED FOR WV

XXXXXXXXX

XXXXXXXXX

XXXXXXXX

XXXXXXXX

13. STAMPED AND TRANSFERRED TO OTHER STATES

XXXXXXXXX

XXXXXXXXX

XXXXXXXX

XXXXXXXX

14. SOLD TO FEDERAL GOVERNMENT

XXXXXXXXX

XXXXXXXXX

XXXXXXXX

XXXXXXXX

15. SALES IN APPROPRIATE STATE (you must complete

XXXXXXXXX

XXXXXXXX

schedule 3 for column G and H ONLY)

16. RETURNED TO MANUFACTURER

17. DESTROYED BY FIRE OR FLOOD

18. TOTAL DISPOSALS (ADD LINES 12 THRU 17)

19. *GAIN (LINE 18 GREATER THAN 11 ENTER HERE)

20. *LOSS (LINE 18 LESS THAN 11 ENTER HERE)

21. TOTAL OF COL. E, LINE 20 + COL. G, LINE 19 _____________ X .55 =

$ _______________

22. TOTAL OF COL. F, LINE 20 + COL. H, LINE 19 ______________ X .6875 = $ _______________

I, ____________________________________________, CERTIFY OR AFFIRM THAT THE STATEMENTS AND ITEMS ENTERED HEREIN ARE CORRECT

TO THE BEST OF MY KNOWLEDGE.

DATE: ________________________

NAME: _______________________________________(SIGNATURE)

TITLE:__________________________

YOU MUST KEEP A COPY OF THIS REPORT FOR YOUR RECORDS

ADDITIONAL TAX DUE WITH THIS REPORT

$

,

.

(LINES 21 + 22)

FOR INSTRUCTIONS AND/OR INFORMATION, CONTACT:

DO NOT USE THIS SPACE

DEPARTMENT OF TAX AND REVENUE

P. O. BOX 2666

CHARLESTON, WEST VIRGINIA 25330-2666

*O42120601W*

(304) 558-8619 or 8618

USE BLUE OR BLACK INK ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2