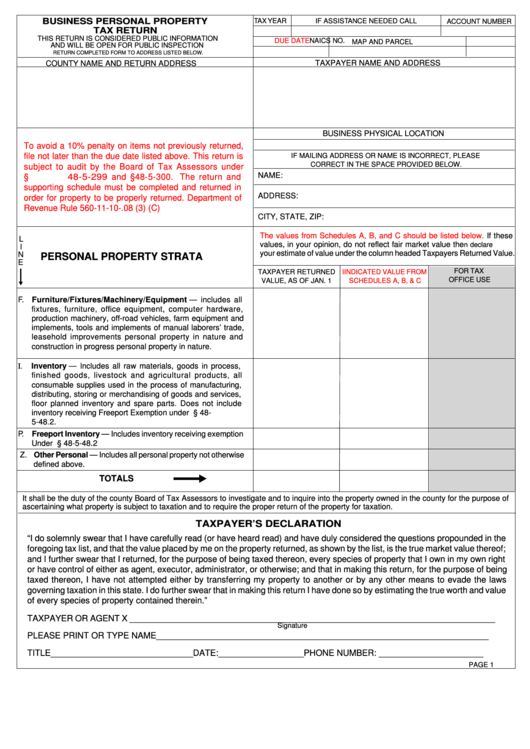

BUSINESS PERSONAL PROPERTY

TAX YEAR

IF ASSISTANCE NEEDED CALL

ACCOUNT NUMBER

TAX RETURN

THIS RETURN IS CONSIDERED PUBLIC INFORMATION

MAP AND PARCEL I.D. NO.

DUE DATE

NAICS NO.

AND WILL BE OPEN FOR PUBLIC INSPECTION

RETURN COMPLETED FORM TO ADDRESS LISTED BELOW.

TAXPAYER NAME AND ADDRESS

COUNTY NAME AND RETURN ADDRESS

BUSINESS PHYSICAL LOCATION

To avoid a 10% penalty on items not previously returned,

file not later than the due date listed above. This return is

IF MAILING ADDRESS OR NAME IS INCORRECT, PLEASE

CORRECT IN THE SPACE PROVIDED BELOW.

subject to audit by the Board of Tax Assessors under

NAME:

O.C.G.A. §48-5-299 and §48-5-300. The return and

supporting schedule must be completed and returned in

ADDRESS:

order for property to be properly returned. Department of

Revenue Rule 560-11-10-.08 (3) (C)

CITY, STATE, ZIP:

The values from Schedules A, B, and C should be listed below.

If these

L

values, in your opinion, do not reflect fair market value the

n declare

I

your estimate of value under the column headed Taxpayers Returned Value.

N

PERSONAL PROPERTY STRATA

E

FOR TAX

TAXPAYER RETURNED

IINDICATED VALUE FROM

OFFICE USE

VALUE, AS OF JAN. 1

SCHEDULES A, B, & C

F. Furniture/Fixtures/Machinery/Equipment — includes all

fixtures, furniture, office equipment, computer hardware,

production machinery, off-road vehicles, farm equipment and

implements, tools and implements of manual laborers’ trade,

leasehold improvements personal property in nature and

construction in progress personal property in nature.

I.

Inventory — Includes all raw materials, goods in process,

finished goods, livestock and agricultural products, all

consumable supplies used in the process of manufacturing,

distributing, storing or merchandising of goods and services,

floor planned inventory and spare parts. Does not include

inventory receiving Freeport Exemption under O.C.G.A. § 48-

5-48.2.

P. Freeport Inventory — Includes inventory receiving exemption

Under O.C.G.A. § 48-5-48.2

Z. Other Personal — Includes all personal property not otherwise

defined above.

TOTALS

It shall be the duty of the county Board of Tax Assessors to investigate and to inquire into the property owned in the county for the purpose of

ascertaining what property is subject to taxation and to require the proper return of the property for taxation.

TAXPAYER’S DECLARATION

“I do solemnly swear that I have carefully read (or have heard read) and have duly considered the questions propounded in the

foregoing tax list, and that the value placed by me on the property returned, as shown by the list, is the true market value thereof;

and I further swear that I returned, for the purpose of being taxed thereon, every species of property that I own in my own right

or have control of either as agent, executor, administrator, or otherwise; and that in making this return, for the purpose of being

taxed thereon, I have not attempted either by transferring my property to another or by any other means to evade the laws

governing taxation in this state. I do further swear that in making this return I have done so by estimating the true worth and value

of every species of property contained therein.”

TAXPAYER OR AGENT X _____________________________________________________________________________

Signature

PLEASE PRINT OR TYPE NAME ______________________________________________________________________

TITLE ______________________________ DATE: __________________ PHONE NUMBER: ______________________

PAGE 1

1

1 2

2 3

3 4

4