Business Certificate Application Form - City Of Fontana

ADVERTISEMENT

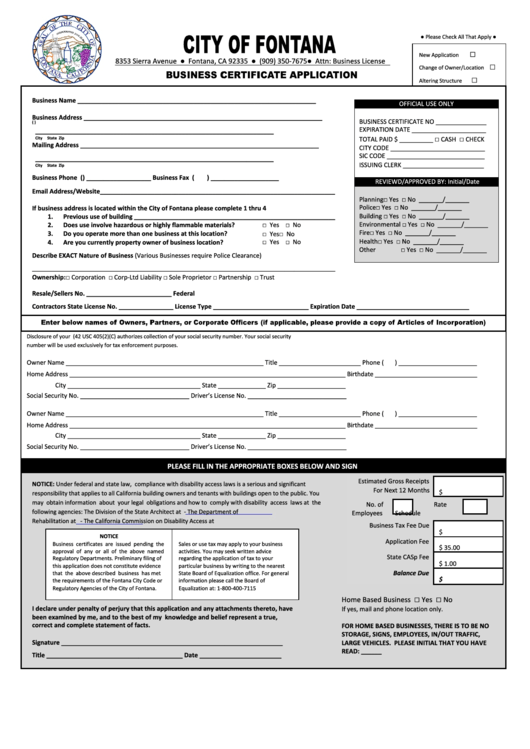

● Please Check All That Apply ●

□

New Application

8353 Sierra Avenue ● Fontana, CA 92335 ● (909) 350-7675 ● Attn: Business License

□

Change of Owner/Location

□

Altering Structure

Business Name

______________________________________________________________________

OFFICIAL USE ONLY

Business Address

______________________________________________________________________

BUSINESS CERTIFICATE NO _______________

(P.O. Box NOT Allowed)

EXPIRATION DATE ______________________

______________________________________________________________________

□

□

City

State

Zip

TOTAL PAID $ __________

CASH

CHECK

Mailing Address

______________________________________________________________________

CITY CODE ____________________________

SIC CODE _____________________________

______________________________________________________________________

ISSUING CLERK ________________________

City

State

Zip

Business Phone

(

) ___________________

Business Fax

(

) ____________________

REVIEWD/APPROVED BY: Initial/Date

Email Address/Website_____________________________________________________________________

Planning

□ Yes □ No _______/_______

Police

□ Yes □ No _______/_______

If business address is located within the City of Fontana please complete 1 thru 4

Building

□ Yes □ No _______/_______

1.

Previous use of building ___________________________________________________________

Environmental □ Yes □ No _______/_______

2.

Does use involve hazardous or highly flammable materials?

□ Yes □ No

Fire

□ Yes □ No _______/_______

3.

Do you operate more than one business at this location?

□ Yes □ No

Health

□ Yes □ No _______/_______

4.

Are you currently property owner of business location?

□ Yes □ No

Other

□ Yes □ No _______/_______

Describe EXACT Nature of Business (Various Businesses require Police Clearance)

_________________________________________________________________________________________

Ownership: □ Corporation

□ Corp-Ltd Liability

□ Sole Proprietor

□ Partnership

□ Trust

Resale/Sellers No. _________________________ Federal I.D. No. __________________________ State I.D. No. ___________________________________

Contractors State License No. ________________ License Type ____________________________ Expiration Date _________________________________

Disclosure of your U.S. Social Security Number is mandatory on this application. Public Law 94-455 (42 USC 405(2)(C) authorizes collection of your social security number. Your social security

number will be used exclusively for tax enforcement purposes.

Owner Name __________________________________________________________ Title ________________________ Phone (

) _______________________

Home Address _________________________________________________________________________________ Birthdate ______________________________

City _______________________________________ State ______________ Zip ____________________

Social Security No. ________________________________ Driver’s License No. _____________________________

Owner Name __________________________________________________________ Title ________________________ Phone (

) _______________________

Home Address _________________________________________________________________________________ Birthdate ______________________________

City _______________________________________ State ______________ Zip ____________________

Social Security No. ________________________________ Driver’s License No. _____________________________

PLEASE FILL IN THE APPROPRIATE BOXES BELOW AND SIGN

Estimated Gross Receipts

NOTICE: Under federal and state law, compliance with disability access laws is a serious and significant

For Next 12 Months

$

responsibility that applies to all California building owners and tenants with buildings open to the public. You

may obtain information about your legal obligations and how to comply with disability access laws at the

No. of

Rate

following agencies: The Division of the State Architect at

- The Department of

Employees

Schedule

Rehabilitation at

- The California Commission on Disability Access at

Business Tax Fee Due

$

NOTICE

Application Fee

Business certificates are issued pending the

Sales or use tax may apply to your business

$ 35.00

approval of any or all of the above named

activities. You may seek written advice

State CASp Fee

Regulatory Departments. Preliminary filing of

regarding the application of tax to your

$ 1.00

this application does not constitute evidence

particular business by writing to the nearest

Balance Due

that the above described business has met

State Board of Equalization office. For general

$

the requirements of the Fontana City Code or

information

please

call

the

Board

of

Regulatory Agencies of the City of Fontana.

Equalization at: 1-800-400-7115

□

□

Home Based Business

Yes

No

I declare under penalty of perjury that this application and any attachments thereto, have

If yes, mail and phone location only.

been examined by me, and to the best of my knowledge and belief represent a true,

correct and complete statement of facts.

FOR HOME BASED BUSINESSES, THERE IS TO BE NO

STORAGE, SIGNS, EMPLOYEES, IN/OUT TRAFFIC,

Signature _________________________________________________________________

LARGE VEHICLES. PLEASE INITIAL THAT YOU HAVE

READ: ______

Title ________________________________________ Date ________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2