Form Ir-15 - Individual Income Tax Return - 2015

ADVERTISEMENT

(Tax Office Use Only)

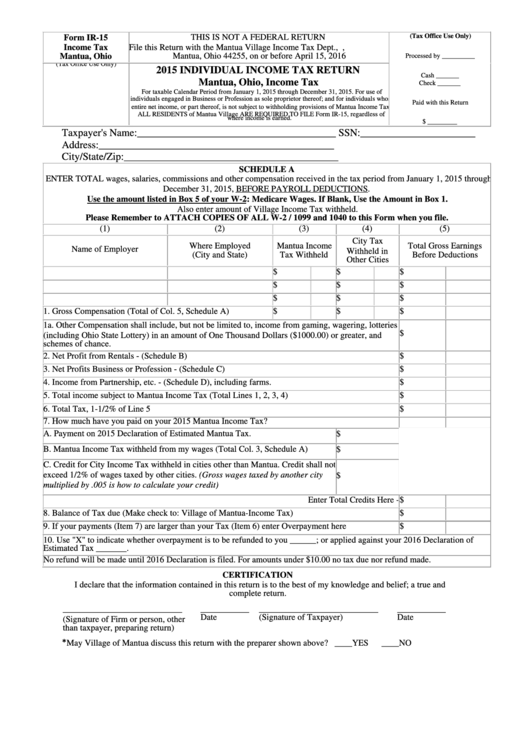

Form IR-15

THIS IS NOT A FEDERAL RETURN

Income Tax

File this Return with the Mantua Village Income Tax Dept., P.O. Box 775,

Processed by __________

Mantua, Ohio

Mantua, Ohio 44255, on or before April 15, 2016

(Tax Office Use Only)

2015 INDIVIDUAL INCOME TAX RETURN

Cash _______

Mantua, Ohio, Income Tax

Check _______

For taxable Calendar Period from January 1, 2015 through December 31, 2015. For use of

individuals engaged in Business or Profession as sole proprietor thereof; and for individuals whose

Paid with this Return

entire net income, or part thereof, is not subject to withholding provisions of Mantua Income Tax.

ALL RESIDENTS of Mantua Village ARE REQUIRED TO FILE Form IR-15, regardless of

where income is earned.

$ _________

Taxpayer's Name:______________________________________ SSN:______________________

Address:_____________________________________________

City/State/Zip:_________________________________________

SCHEDULE A

ENTER TOTAL wages, salaries, commissions and other compensation received in the tax period from January 1, 2015 through

December 31, 2015, BEFORE PAYROLL DEDUCTIONS.

Use the amount listed in Box 5 of your W-2: Medicare Wages. If Blank, Use the Amount in Box 1.

Also enter amount of Village Income Tax withheld.

Please Remember to ATTACH COPIES OF ALL W-2 / 1099 and 1040 to this Form when you file.

(1)

(2)

(3)

(4)

(5)

City Tax

Where Employed

Mantua Income

Total Gross Earnings

Name of Employer

Withheld in

(City and State)

Tax Withheld

Before Deductions

Other Cities

$

$

$

$

$

$

$

$

$

1. Gross Compensation (Total of Col. 5, Schedule A)

$

$

$

1a. Other Compensation shall include, but not be limited to, income from gaming, wagering, lotteries

(including Ohio State Lottery) in an amount of One Thousand Dollars ($1000.00) or greater, and

$

schemes of chance.

2. Net Profit from Rentals - (Schedule B)

$

3. Net Profits Business or Profession - (Schedule C)

$

4. Income from Partnership, etc. - (Schedule D), including farms.

$

5. Total income subject to Mantua Income Tax (Total Lines 1, 2, 3, 4)

$

6. Total Tax, 1-1/2% of Line 5

$

7. How much have you paid on your 2015 Mantua Income Tax?

A. Payment on 2015 Declaration of Estimated Mantua Tax.

$

B. Mantua Income Tax withheld from my wages (Total Col. 3, Schedule A)

$

C. Credit for City Income Tax withheld in cities other than Mantua. Credit shall not

exceed 1/2% of wages taxed by other cities. (Gross wages taxed by another city

$

multiplied by .005 is how to calculate your credit)

Enter Total Credits Here - $

8. Balance of Tax due (Make check to: Village of Mantua-Income Tax)

$

9. If your payments (Item 7) are larger than your Tax (Item 6) enter Overpayment here

$

10. Use "X" to indicate whether overpayment is to be refunded to you ______; or applied against your 2016 Declaration of

Estimated Tax _______.

No refund will be made until 2016 Declaration is filed. For amounts under $10.00 no tax due nor refund made.

CERTIFICATION

I declare that the information contained in this return is to the best of my knowledge and belief; a true and

complete return.

___________________________

___________

___________________________

___________

(Signature of Firm or person, other

Date

(Signature of Taxpayer)

Date

than taxpayer, preparing return)

*

May Village of Mantua discuss this return with the preparer shown above? ____YES

____NO

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1