Estimated Tax Worksheet

ADVERTISEMENT

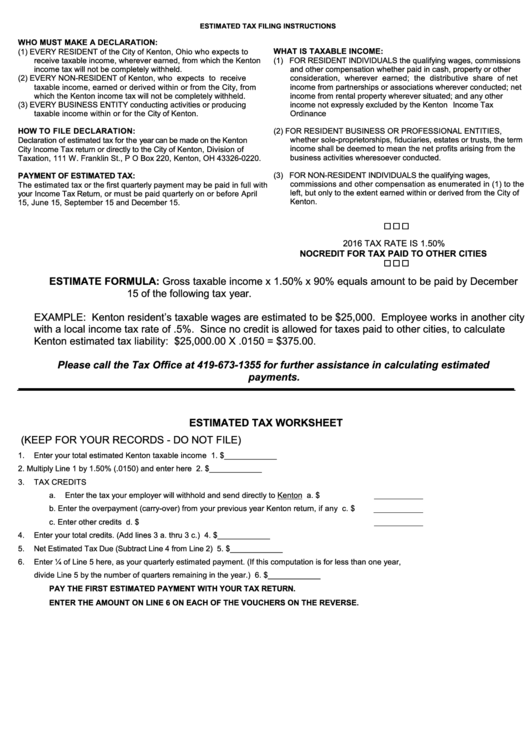

ESTIMATED TAX FILING INSTRUCTIONS

WHO MUST MAKE A DECLARATION:

(1) EVERY RESIDENT of the City of Kenton, Ohio who expects to

WHAT IS TAXABLE INCOME:

receive taxable income, wherever earned, from which the Kenton

(1) FOR RESIDENT INDIVIDUALS the qualifying wages, commissions

income tax will not be completely withheld.

and other compensation whether paid in cash, property or other

(2) EVERY NON-RESIDENT of Kenton, who expects to receive

consideration, wherever earned; the distributive share of net

taxable income, earned or derived within or from the City, from

income from partnerships or associations wherever conducted; net

which the Kenton income tax will not be completely withheld.

income from rental property wherever situated; and any other

(3) EVERY BUSINESS ENTITY conducting activities or producing

income not expressly excluded by the Kenton Income Tax

taxable income within or for the City of Kenton.

Ordinance

HOW TO FILE DECLARATION:

(2) FOR RESIDENT BUSINESS OR PROFESSIONAL ENTITIES,

whether sole-proprietorships, fiduciaries, estates or trusts, the term

Declaration of estimated tax for the year can be made on the Kenton

income shall be deemed to mean the net profits arising from the

City Income Tax return or directly to the City of Kenton, Division of

business activities wheresoever conducted.

Taxation, 111 W. Franklin St., P O Box 220, Kenton, OH 43326-0220.

(3) FOR NON-RESIDENT INDIVIDUALS the qualifying wages,

PAYMENT OF ESTIMATED TAX:

commissions and other compensation as enumerated in (1) to the

The estimated tax or the first quarterly payment may be paid in full with

left, but only to the extent earned within or derived from the City of

your Income Tax Return, or must be paid quarterly on or before April

Kenton.

15, June 15, September 15 and December 15.

2016 TAX RATE IS 1.50%

NO CREDIT FOR TAX PAID TO OTHER CITIES

ESTIMATE FORMULA: Gross taxable income x 1.50% x 90% equals amount to be paid by December

15 of the following tax year.

EXAMPLE: Kenton resident’s taxable wages are estimated to be $25,000. Employee works in another city

with a local income tax rate of .5%. Since no credit is allowed for taxes paid to other cities, to calculate

Kenton estimated tax liability: $25,000.00 X .0150 = $375.00.

Please call the Tax Office at 419-673-1355 for further assistance in calculating estimated

payments.

ESTIMATED TAX WORKSHEET

(KEEP FOR YOUR RECORDS - DO NOT FILE)

1.

Enter your total estimated Kenton taxable income ........................................................................................................... 1. $____________

2.

Multiply Line 1 by 1.50% (.0150) and enter here .............................................................................................................. 2. $____________

3.

TAX CREDITS

a.

Enter the tax your employer will withhold and send directly to Kenton ......................... a. $

b.

Enter the overpayment (carry-over) from your previous year Kenton return, if any ....... c. $

c.

Enter other credits ...................................................................................................... d. $

4.

Enter your total credits. (Add lines 3 a. thru 3 c.) ............................................................................................................. 4. $____________

5.

Net Estimated Tax Due (Subtract Line 4 from Line 2) ...................................................................................................... 5. $____________

6.

Enter ¼ of Line 5 here, as your quarterly estimated payment. (If this computation is for less than one year,

divide Line 5 by the number of quarters remaining in the year.)....................................................................................... 6. $____________

PAY THE FIRST ESTIMATED PAYMENT WITH YOUR TAX RETURN.

ENTER THE AMOUNT ON LINE 6 ON EACH OF THE VOUCHERS ON THE REVERSE.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2