IT-AFF1 (Rev. 12/11)

Clear

Print

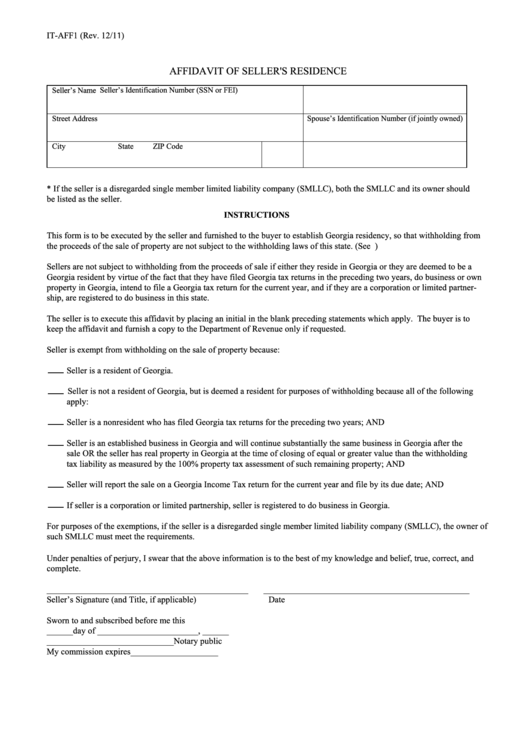

AFFIDAVIT OF SELLER'S RESIDENCE

Seller’s Identification Number (SSN or FEI)

Seller’s Name

Spouse’s Identification Number (if jointly owned)

Street Address

City

State

ZIP Code

* If the seller is a disregarded single member limited liability company (SMLLC), both the SMLLC and its owner should

be listed as the seller.

INSTRUCTIONS

This form is to be executed by the seller and furnished to the buyer to establish Georgia residency, so that withholding from

the proceeds of the sale of property are not subject to the withholding laws of this state. (See O.C.G.A. Section 48-7-128.)

Sellers are not subject to withholding from the proceeds of sale if either they reside in Georgia or they are deemed to be a

Georgia resident by virtue of the fact that they have filed Georgia tax returns in the preceding two years, do business or own

property in Georgia, intend to file a Georgia tax return for the current year, and if they are a corporation or limited partner-

ship, are registered to do business in this state.

The seller is to execute this affidavit by placing an initial in the blank preceding statements which apply. The buyer is to

keep the affidavit and furnish a copy to the Department of Revenue only if requested.

Seller is exempt from withholding on the sale of property because:

Seller is a resident of Georgia.

Seller is not a resident of Georgia, but is deemed a resident for purposes of withholding because all of the following

apply:

Seller is a nonresident who has filed Georgia tax returns for the preceding two years; AND

Seller is an established business in Georgia and will continue substantially the same business in Georgia after the

sale OR the seller has real property in Georgia at the time of closing of equal or greater value than the withholding

tax liability as measured by the 100% property tax assessment of such remaining property; AND

Seller will report the sale on a Georgia Income Tax return for the current year and file by its due date; AND

If seller is a corporation or limited partnership, seller is registered to do business in Georgia.

For purposes of the exemptions, if the seller is a disregarded single member limited liability company (SMLLC), the owner of

such SMLLC must meet the requirements.

Under penalties of perjury, I swear that the above information is to the best of my knowledge and belief, true, correct, and

complete.

______________________________________________

_______________________________________________

Seller’s Signature (and Title, if applicable)

Date

Sworn to and subscribed before me this

______day of _______________________, ______

_____________________________Notary public

My commission expires____________________

1

1