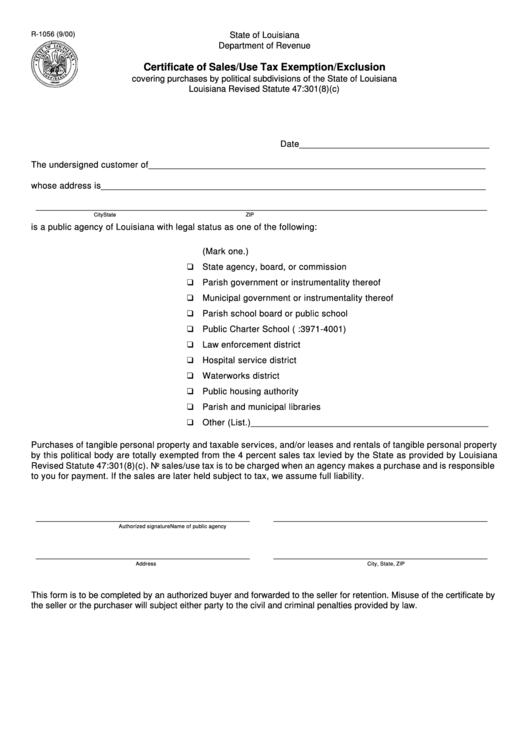

R-1056 (9/00)

State of Louisiana

Department of Revenue

Certificate of Sales/Use Tax Exemption/Exclusion

covering purchases by political subdivisions of the State of Louisiana

Louisiana Revised Statute 47:301(8)(c)

Date ________________________________________

The undersigned customer of _______________________________________________________________________

whose address is _________________________________________________________________________________

_______________________________________________________________________________________________

City

State

ZIP

is a public agency of Louisiana with legal status as one of the following:

(Mark one.)

State agency, board, or commission

Parish government or instrumentality thereof

Municipal government or instrumentality thereof

Parish school board or public school

Public Charter School (R.S. 17:3971-4001)

Law enforcement district

Hospital service district

Waterworks district

Public housing authority

Parish and municipal libraries

Other (List.) __________________________________________________

Purchases of tangible personal property and taxable services, and/or leases and rentals of tangible personal property

by this political body are totally exempted from the 4 percent sales tax levied by the State as provided by Louisiana

Revised Statute 47:301(8)(c). No sales/use tax is to be charged when an agency makes a purchase and is responsible

to you for payment. If the sales are later held subject to tax, we assume full liability.

_____________________________________________

_____________________________________________

Authorized signature

Name of public agency

_____________________________________________

_____________________________________________

Address

City, State, ZIP

This form is to be completed by an authorized buyer and forwarded to the seller for retention. Misuse of the certificate by

the seller or the purchaser will subject either party to the civil and criminal penalties provided by law.

1

1