Contact the Following Agencies for Assistance

Charitable Activities

Internal Revenue Service

Corporation Division

Section

phone:

(877)829-5500 & (800)829-1040

Public Service Building

Oregon Department of Justice

TTY:

(800)829-4059

255 Capitol Street NE, Suite 151

th

1515 SW 5

Avenue, Suite 410

web site:

Salem, OR 97310

Portland, Oregon 97201-5451

phone:

(503)986-2200

phone:

(503)229-5725

TTY:

(503)986-2328

Issues

TTY:

(503)378-5938

fax:

(503)378-4381

•

Obtaining federal tax-exempt status

fax:

(503)229-5120

web site:

•

e-mail:

charitable.activities@doj.state.or.us

Completing federal tax forms

web site: http:

Forms

Issues

Issues

•

SS-4, Application for Employer

•

Forming a new corporation

•

Questions about annual reports for

Identification Number

•

Obtaining state and federal tax

•

charitable organizations-Forms CT-12,

990, Return of Organization Exempt

identification numbers

CT-12F, and CT-12S

From Income Tax

•

Merging nonprofit corporations

•

Registration of charitable corporations or

•

990-EZ, Short Form - Return of

•

Dissolving nonprofit corporations

trusts

Organization Exempt From Income Tax

•

Amending articles of incorporation

•

Merging nonprofit organizations

•

Schedule A, for Form 990 and 990-EZ

•

Obtaining copies of filed articles of

•

Dissolving nonprofit organizations

•

990-PF, Return of Private Foundation

incorporation and amendments

•

•

Reporting illegal activity by nonprofit

990-T, Exempt Organization Business

organizations

Income Tax Return

Forms

•

Serving as a board member of a nonprofit

•

990-W, Estimated Tax on Unrelated

•

Articles of Incorporation

organization

Business Taxable Income for Tax-Exempt

•

•

Assumed Business Name Registration

Information about charitable

Organizations

•

•

Articles of Amendment

organizations and copies of annual reports

1023, Application for Recognition of

•

Articles of Correction

Exemption

•

•

1024, Application for Recognition of

Restated Articles of Incorporation

Forms

•

Exemption Under §501(a)

Articles of Merger

•

RF-C, Registration Form for Charitable

•

•

1041, U.S. Income Tax Return for Estates

Articles of Dissolution

Corporations

and Trusts

•

Articles of Revocation or Dissolution

•

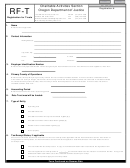

RF-T, Registration Form for Trusts

•

1041-A, U.S. Information Return - Trust

•

CT-12, Annual Report Form for Domestic

Accumulation of Charitable Amounts

Publications

Operating Charities

•

1128, Application to Adopt, Change, or

•

•

CT-12F, Annual Report Form for Foreign

Oregon Business Guide

Retain a Tax Year

Charities

•

2758, Application for Extension of Time

•

CT-12S, Annual Report Form for

Oregon Department

To File Certain Excise, Income,

Domestic Trusts with Non-Charitable

Information, and Other Returns

of Revenue

Beneficiaries

•

4506-A, Request for Public Inspection or

•

Closing Form

Copy of Exempt Organization Tax Form

•

4720, Return of Certain Excise Taxes on

Revenue Building, Room #135

Publications

Charities and Other Persons

955 Center St. NE

•

5227, Split-Interest Trust Return

•

Oregon Wise Giving Guide

Salem, OR 97310

•

8282, Donee Information Return

•

Oregon Business Giving Guide

phone:

(503)378-4988 and (800)356-4222

•

8718, User Fee for Exempt Organization

•

A Guide to Non-Profit Board Service in

TTY:

(503)945-8617 and (800)886-7204

Determination Letter Request

Oregon

web site:

•

8868, Application for Extension of Time

to File an Exempt Organization Return

Issues

Oregon Revised Statutes

•

State taxation and filing requirements

Chapter #65, Nonprofit Corporations

Publications

•

Chapter #128, Trusts; Charitable

•

Pub. 520, Scholarships and Fellowships

Activities

Forms

•

Pub. 526, Charitable Contributions

•

Chapter #464, Games

20, Oregon Corporation Excise Tax Return

•

Pub. 538, Accounting Periods and

•

Chapter #646, Trade Regulations &

41, Oregon Fiduciary Income Tax Return

Methods

Practice

IT-1, Oregon Inheritance Tax Return

•

Pub. 557, Tax-Exempt Status for Your

Organization

Oregon Administrative Rules

•

Pub. 578 Tax Information for Private

•

Foundations and Foundation Managers

Chapter #137-010-005 et seq.

•

Pub. 583 Starting a Business and Keeping

Records

•

Pub. 598 Tax on Unrelated Business

Income of Exempt Organizations

4

1

1 2

2 3

3 4

4 5

5